Investing your money wisely is a key financial decision, and understanding how your investments grow over time is crucial. The Future Value (FPE) calculator helps you estimate the future worth of your investment, taking into account the principal amount, interest rate, and the number of years the money is invested.

Formula

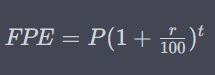

The Future Value (FPE) formula calculates the future worth of an investment:

Where:

- is the Future Value (FPE) of the investment.

- is the principal amount (the initial investment or deposit).

- is the annual interest rate (in percentage).

- is the number of years the money is invested.

How to Use

Using our FPE Calculator is straightforward:

- Enter the principal amount (initial investment).

- Input the annual interest rate (in percentage).

- Specify the number of years the money will be invested.

- Click the “Calculate” button.

The calculator will then display the estimated Future Value (FPE) of your investment.

Example

Let’s say you invest $5,000 at an annual interest rate of 8% for 5 years. Using the FPE Calculator:

- Principal Amount (P): $5,000

- Interest Rate (r): 8%

- Time (t): 5 years

After calculating, the Future Value (FPE) of your investment will be displayed.

FAQs

1. What is the Future Value (FPE)?

The Future Value (FPE) is the estimated worth of an investment at a future date, considering compound interest.

2. How does compound interest affect FPE?

Compound interest means that your investment earns interest not only on the initial principal but also on the accumulated interest.

3. Is the FPE Calculator suitable for all types of investments?

Yes, you can use it for various investments, including savings accounts, certificates of deposit, and more.

4. Can I change the time unit (e.g., months) instead of years?

The calculator is designed for years, but you can adjust it for other time units by converting them to years.

5. What happens if I have regular contributions to the investment?

The FPE Calculator assumes a single initial investment, but regular contributions can be incorporated manually.

6. How accurate is this calculator?

It provides a close estimate, but real-world results may vary due to factors like compounding frequency.

7. Can I use this calculator for loan calculations?

No, this calculator is specifically for estimating the future value of investments, not loans.

8. Is the interest rate compounded annually by default?

Yes, the calculator assumes annual compounding. If it’s different, you’ll need to adjust the formula accordingly.

Conclusion

Understanding the future value of your investments is essential for making informed financial decisions. Our Future Value (FPE) Calculator simplifies this process, providing a quick estimate of your investment’s growth. Whether you’re planning for retirement, saving for a major purchase, or investing for any other reason, this tool can help you visualize the potential outcome of your investments. Start using it today to plan your financial future more effectively.