Imputed Interest is a concept often used in financial calculations to determine the hypothetical interest on a financial transaction. Use the Imputed Interest Calculator below. This interest is calculated even if there is no explicit interest rate associated with the transaction. The Imputed Interest Calculator is a useful tool to compute this value.

Imputed Interest Calculator – Estimate Taxable Interest on Below-Market Loans

Our team converts drinks into code — fuel us to build more free tools!

Imputed Interest Calculator Formula

Imputed Interest = [ Principal Amount × Annual Interest Rate × Time Period (in years) ] / 100

Imputed Interest=Principal Amount×Annual Interest Rate×Time Period (in years)100Imputed Interest=100Principal Amount×Annual Interest Rate×Time Period (in years)

Where:

- Principal Amount: The initial amount of the financial transaction.

- Annual Interest Rate (%): The hypothetical annual interest rate applied.

- Time Period (years): The duration for which imputed interest is calculated.

How to Use the Imputed Interest Calculator

- Input the Principal Amount: Enter the initial amount involved in the financial transaction.

- Input the Annual Interest Rate (%): Specify the hypothetical annual interest rate.

- Input the Time Period (years): Enter the duration for which you want to calculate imputed interest.

- Click the “Calculate” button to obtain the result.

Background and Importance of Imputed Interest Calculations

Imputed interest plays a crucial role in financial transactions, serving as a tool for fair value estimation in scenarios where an explicit interest rate is absent. This concept is particularly vital in understanding the tax implications and regulatory compliance in intra-family or private loans.

From a tax perspective, imputed interest is essential for accurately reporting income and expenses. For instance, in the United States, the Internal Revenue Service (IRS) mandates the use of imputed interest in certain loan transactions to prevent tax avoidance through interest-free or low-interest loans.

- use our Mortgage Amortization Calculator

According to IRS guidelines, if the interest on a loan is less than the applicable federal rate (AFR), the difference between the actual interest paid and the interest that would have been paid at the AFR is considered imputed interest. This imputed interest is treated as taxable income for the lender and, in some cases, as a potential gift for tax purposes.

In the context of intra-family loans, imputed interest ensures that such transactions bear resemblance to “arm’s length” transactions, thereby avoiding potential tax evasion. For example, if a parent lends a significant amount to a child without interest or at a rate below the AFR, the IRS may impute interest on the loan. This imputation recognizes the forgone interest as a transfer of wealth, subject to gift tax rules.

From a legal and regulatory standpoint, imputed interest is a concept recognized and enforced in various jurisdictions beyond the U.S. These regulations are designed to ensure that financial transactions, especially loans, are conducted in a manner that reflects market realities and fairness, both for tax and financial reporting purposes. The failure to appropriately apply imputed interest in applicable scenarios can lead to significant legal and financial repercussions, including penalties and increased tax liabilities.

Users of the Imputed Interest Calculator should be aware of these implications. The calculator assists in determining the appropriate amount of imputed interest in accordance with prevailing rates like the AFR, thereby aiding in compliance with tax regulations and maintaining the integrity of financial transactions. It is a valuable tool for individuals and businesses engaged in private loans, ensuring that their transactions align with legal and tax requirements.

Real-World Applications and Implications of Imputed Interest

Imputed interest is a critical concept in various real-life financial scenarios, particularly where the exchange of funds occurs without an explicit interest rate. Here are a few examples illustrating its importance:

Intra-Family Loans: Imagine a parent lending $50,000 to their child to buy a house, with no interest charged. Without imputed interest, this transaction could be seen as a tax avoidance strategy.

However, the IRS would require the calculation of imputed interest at the applicable federal rate (AFR) to determine the minimum interest that should have been charged for tax purposes. The parent might then have to report this imputed interest as income, and it could also be considered a gift, impacting gift tax liabilities.

Employee Loans: A company might offer a zero-interest loan to an employee as part of a benefits package. Without imputed interest, this could be seen as untaxed income. By applying imputed interest, the IRS ensures that the employee pays tax on the benefit received from the interest-free loan, and the employer can accurately report this as an expense.

Corporate Shareholder Loans: Consider a scenario where a corporation gives a loan to a shareholder with a below-market interest rate. The IRS would use imputed interest to assess the correct amount of taxable interest income for the corporation and interest expense for the shareholder, ensuring fair tax treatment.

Private Loans for Business Investment: If a business owner receives a low-interest loan from a friend to invest in their business, the IRS may impute interest on this loan. This ensures that the lender reports realistic income from the interest, and the borrower correctly deducts interest expenses.

Legal Settlements Paid Over Time: In legal settlements where payments are made over time without interest, imputed interest can be applied to determine the present value of the settlement, impacting the tax treatment of these payments.

These examples demonstrate how imputed interest is used to ensure fairness and transparency in financial transactions, especially in the eyes of tax authorities. It helps prevent tax evasion through interest-free or below-market rate loans and ensures that all parties in a transaction are taxed appropriately based on the economic value exchanged.

Useful Sources and Reading Material about Imputed Interests

For a comprehensive understanding of imputed interest, particularly in relation to IRS rules and regulations, the following sources are highly valuable:

- IRS Publication 550 (2022), Investment Income and Expenses: This publication offers detailed information on the tax treatment of investment income and expenses, including aspects related to imputed interest. It’s a valuable resource for understanding how various types of investment income, such as interest, dividends, and capital gains, are treated under U.S. tax law. It also provides guidance on deducting investment expenses. For more details, visit the IRS website here.

- Paragon Accountants – IRS Tax Rules For Imputed Interest: This article provides a practical overview of how the IRS approaches imputed interest, especially in the context of below-market-rate loans. It explains the concept of imputed interest and its application in different types of loans, including gift loans, compensation-related loans, and loans between shareholders and corporations. The article also discusses exceptions to these rules and emphasizes the importance of consulting with a tax professional for compliance. For more information, you can read the full article here.

- IRS Applicable Federal Rates (AFRs): The IRS regularly publishes Applicable Federal Rates, which are crucial for calculating imputed interest. These rates are used to determine the minimum interest rate that should be applied to various financial transactions, particularly loans, to avoid tax complications. The AFRs are updated monthly and are available on the IRS website, offering a valuable resource for staying current with the rates needed for accurate imputed interest calculations. You can access the latest AFRs here.

These resources provide a solid foundation for understanding imputed interest, its tax implications, and the legal framework surrounding it, which is essential for users of the Imputed Interest Calculator to make informed decisions.

Table of Various Imputed Interest Calculator Calculations

Below is a detailed table of imputed interest calculations. This table is formatted in a way that should be easy to understand Loan Amount, its Interest Rate, AFR rate, Loan Term and Imputed Interest over term.

Loan Amount | Interest Rate | AFR Rate | Loan Term | Annual Imputed Interest | Total Imputed Interest Over Term

------------|---------------|----------|-----------|-------------------------|----------------------------------

$10,000 | 0% | 2.5% | 5 years | $250 | $1,250

$20,000 | 1% | 3% | 10 years | $400 | $4,000

$50,000 | 0% | 2.8% | 3 years | $1,400 | $4,200

$100,000 | 2% | 4% | 7 years | $2,000 | $14,000

$150,000 | 1.5% | 3.5% | 5 years | $3,000 | $15,000

This table includes columns for the loan amount, the actual interest rate on the loan, the applicable federal rate (AFR), the loan term in years, the annual imputed interest calculated, and the total imputed interest over the term of the loan.

The imputed interest is calculated as the difference between the AFR and the actual interest rate, multiplied by the loan amount.

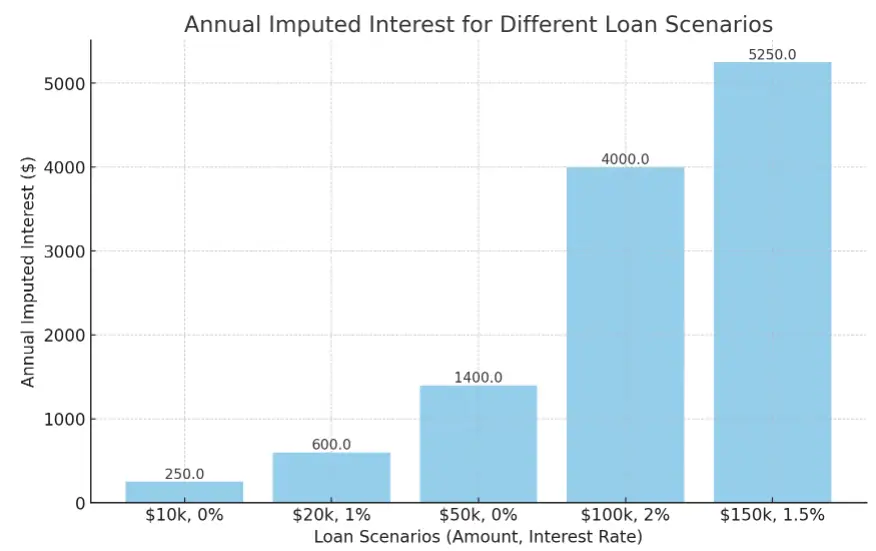

Imputed Interest Calculator Chart Data Visualization

Creating a chart or data visualization requires specific data points to illustrate. For the topic of imputed interest, we can create a chart that showcases a few scenarios with varying loan amounts, interest rates, and the resulting imputed interest calculations.

Let’s consider the following scenarios for the chart:

- Loan of $10,000 at 0% interest with an AFR of 2.5%.

- Loan of $20,000 at 1% interest with an AFR of 3%.

- Loan of $50,000 at 0% interest with an AFR of 2.8%.

- Loan of $100,000 at 2% interest with an AFR of 4%.

- Loan of $150,000 at 1.5% interest with an AFR of 3.5%.

Below, we have created a bar chart to visualize the annual imputed interest for each of these scenarios.

The bar chart above visualizes the annual imputed interest for different loan scenarios. Each bar represents a unique combination of loan amount and interest rate, with the height indicating the calculated annual imputed interest based on the respective Applicable Federal Rate (AFR).

This visualization aids in understanding how varying loan amounts and interest rates can impact the amount of imputed interest, which is a key consideration in financial transactions involving below-market or zero-interest loans.

Comparison of Imputed Interest with Actual Interest Rates

Understanding the difference between imputed and actual interest rates is crucial for users of an Imputed Interest Calculator. Imputed interest is a theoretical interest rate applied to loans or financial transactions where no explicit interest rate is present or the rate is significantly below the market level. In contrast, the actual interest rate is the explicit rate charged on a loan or investment as agreed upon by the parties involved.

In several situations, imputed interest can diverge substantially from market interest rates, leading to significant implications. One common scenario is in intra-family loans. For instance, a parent might lend money to a child at a very low or zero interest rate.

While the actual interest rate is negligible, the IRS would typically require the use of an imputed interest rate based on the AFR to assess the transaction fairly for tax purposes. This imputed rate often differs from what might be available in the market, especially in a low-interest-rate environment.

Another example is corporate loans to shareholders or employees at below-market rates. While the actual rate might be minimal to facilitate corporate benefit or employee welfare, the imputed rate calculated using market benchmarks reflects the economic value of the benefit received. This difference can lead to tax implications for both the lender and the borrower, as the imputed interest is treated as taxable income or a deductible expense.

These differences in interest rates underscore the importance of understanding and applying the concept of imputed interest correctly. It ensures that financial transactions are evaluated fairly and transparently, reflecting the economic substance over the form, especially in the eyes of tax authorities. For users of Imputed Interest Calculators, this distinction helps in accurately assessing the tax liabilities and financial implications of transactions that involve below-market or interest-free loans.

5 More Real-Life Examples and Use Cases of Imputed Interest

To deepen the understanding of imputed interest, here are some specific real-life examples and use cases:

- Family Loans for Education: Imagine a parent loans their child $30,000 for college education at no interest. The market rate for a similar loan is 4%. The IRS would require the parent to use an imputed interest rate (say, the AFR at 2.5%) for tax purposes. Despite the actual interest rate being 0%, the imputed interest would be calculated on the loan amount at 2.5%, creating a taxable income scenario for the parent.

- Employee Loans for Home Purchase: A company might offer an executive a $500,000 loan for a home purchase at a 1% interest rate as a perk. In the market, a similar loan could have a 3.5% interest rate. The difference in interest (2.5%) is considered by the IRS as imputed interest and is taxable as income for the executive, while the company can claim it as a business expense.

- Business Startup Loans: Consider an entrepreneur receiving a $100,000 loan from a friend at a 1% interest rate to start a business. The market rate for a similar loan is 6%. The IRS would apply an imputed interest rate based on the AFR, say 4%. This difference (3%) would be treated as taxable income for the lender and a deductible business expense for the borrower.

- Zero-Interest Car Loans to Family Members: A person lends their sibling $20,000 to buy a car, charging no interest. The market rate for a similar auto loan is 5%. The IRS would require imputed interest to be calculated using the AFR, possibly around 3%. This imputed interest would be treated as income for the lender and could have gift tax implications as well.

- Below-Market Loans Between Companies and Shareholders: A corporation provides a shareholder a $250,000 loan at 2% interest when the market rate is 5%. The difference (3%) is the imputed interest, which is taxable to the shareholder and considered a constructive dividend, affecting the corporation’s tax reporting.

In each of these cases, the Imputed Interest Calculator becomes a vital tool, helping users compute the appropriate imputed interest and understand their tax obligations. This ensures compliance with tax laws and fair financial reporting, especially in transactions involving loans at below-market interest rates.

Further useful reading Materials about Imputed Interests and how to Calculate

To further your understanding of imputed interest and its real-life applications, I’ve found several informative sources that provide examples and use cases.

- TurboTax Tax Tips & Videos offers insights into how imputed interest operates in the realm of tax regulations. Their focus is on how this concept is applied for transactions that might not have a clear interest rate defined or where the rate is significantly below the market average. This could include situations like family loans or corporate loans to employees at preferential rates. TurboTax’s resources are particularly useful for understanding how these scenarios play out in the context of tax reporting and compliance.

- Due.com provides a comprehensive explanation of imputed interest, emphasizing its importance in business and finance. The platform offers detailed examples that illustrate how imputed interest comes into play in real-world situations. For instance, they discuss scenarios such as below-market loans from a business owner to their company, interest-free loans between family members, and seller financing in real estate with interest rates lower than the market. These examples are useful for understanding how to calculate imputed interest and the implications for tax reporting.

- WallStreetMojo delves into the concept of imputed interest, particularly focusing on its application in various financial scenarios like intra-family loans, gift loans, and compensation-related loans. Their content is geared towards providing a deeper understanding of how imputed interest is used to ensure fair tax treatment and accurate financial reporting in transactions where the interest rate is absent or set artificially low.

These sources offer valuable insights and practical examples that can help users of the Imputed Interest Calculator to understand how imputed interest is calculated and applied in different contexts. They are particularly useful for gaining a comprehensive understanding of the tax implications and financial reporting requirements associated with imputed interest.

For more detailed information, you can visit their respective websites linked above.

Tax Implications of Imputed Interest and Reporting Guidelines

Imputed interest has significant tax implications, particularly in how it influences tax calculations and liabilities. It is crucial for both individuals and businesses engaging in transactions with no or below-market interest rates to understand these implications to ensure compliance with tax laws and regulations.

Impact on Tax Calculations and Liabilities

Income Recognition: When imputed interest is applied to a loan, the lender is deemed to have received interest income, even if no actual interest payments were made. This imputed interest is taxable and must be reported as income. For example, if a parent lends a child $100,000 at a zero interest rate, and the applicable federal rate (AFR) is 2%, the IRS would consider the parent as having received $2,000 in interest income annually, which is subject to tax.

Expense Deduction: Similarly, for the borrower, the imputed interest can sometimes be considered a deductible expense, especially in business-related loans. This can reduce the taxable income of the borrower. For instance, if a business receives a loan from a shareholder at a below-market rate, the imputed interest calculated at the AFR can be deducted as a business expense.

Gift Tax Implications: In personal loan scenarios, such as loans between family members, the IRS may treat the forgone interest (the difference between the imputed interest and any actual interest paid) as a gift. This can have implications for gift tax, especially if the amount exceeds the annual gift tax exclusion limit.

Reporting Imputed Interest on Tax Returns

For Lenders: Lenders must report the imputed interest as income on their tax returns. This is typically done on Schedule B (Form 1040) under the section for interest income. It’s important to document the calculation of the imputed interest, keeping in mind the applicable federal rate at the time of the loan.

For Borrowers: Borrowers, particularly businesses, may be able to deduct imputed interest as an expense. This would typically be reported on Schedule C (Form 1040) for sole proprietors or the appropriate business tax return for other types of business entities.

Record Keeping: Both lenders and borrowers should maintain detailed records of the transaction, including the loan agreement, the method used for calculating imputed interest, and any payments made. This documentation is crucial in case of an IRS inquiry or audit.

Consulting a Tax Professional: Due to the complexities involved in calculating and reporting imputed interest, it is advisable to consult with a tax professional. They can provide guidance tailored to the specific circumstances of the loan and ensure compliance with current tax laws and regulations.

Understanding the tax implications of imputed interest is essential for accurate tax reporting and avoiding potential penalties. By correctly calculating and reporting imputed interest, both lenders and borrowers can ensure they meet their tax obligations and avoid unintended tax consequences. If you’re unsure about how to calculate your tax returns – please consult a professional.

Real-World Case Examples: 5 Tax Implications of Imputed Interest

To illustrate the tax implications of imputed interest, here are several real-world case examples that reflect different scenarios:

Business Loan from an Individual to Their Own Company: Consider an individual who lends $200,000 to their own small business at no interest. The applicable federal rate (AFR) at the time is 3%. For tax purposes, the IRS would view this as the individual having an annual imputed interest income of $6,000 ($200,000 * 3%). This amount must be reported as income on the individual’s tax return, while the business can record this as an interest expense, potentially reducing its taxable income.

Sale of Property with Owner Financing: A property owner sells a real estate property worth $500,000, offering the buyer a loan for the full amount at a 1% interest rate, significantly below the market rate of 4%. The IRS would require the seller to report imputed interest based on the difference between the market rate and the charged rate. This means the seller would have to report additional interest income of $15,000 annually (($500,000 * 4%) – ($500,000 * 1%)), impacting their tax liabilities.

Interest-Free Loan Between Friends: Two friends enter into a loan agreement where one lends the other $50,000 without interest to help start a business. The AFR at the time is 2.5%. The lender is required to report imputed interest of $1,250 annually ($50,000 * 2.5%) as income on their tax return. The borrower, in this case, may not be able to deduct this interest since the loan is not explicitly for business purposes, depending on the specific details of the loan and business.

Corporate Loan to an Executive: A corporation gives an interest-free loan of $300,000 to a high-ranking executive. The AFR is 3%. The IRS would treat this as the executive receiving imputed interest income of $9,000 annually. This imputed income could be subject to additional taxes, like payroll taxes, depending on the terms of the loan and employment agreement.

Gift Loan to a Family Member for Investment: A parent loans their child $100,000 at a 0.5% interest rate to invest in the stock market, while the AFR is 2%. The forgone interest ($1,500 annually calculated using the AFR) might be considered a gift for tax purposes, impacting the parent’s gift tax liabilities if the cumulative amount exceeds the annual gift tax exclusion.

These examples demonstrate how different scenarios involving imputed interest can affect tax calculations and liabilities for both lenders and borrowers. They also underscore the importance of understanding how to report imputed interest on tax returns to ensure compliance with IRS regulations and avoid potential tax disputes.

Applications of Imputed Interest in Various Financial Scenarios

Imputed interest plays a pivotal role in a range of financial scenarios, particularly where the interest rates are not in line with market norms or explicitly specified. Understanding its application in these contexts is crucial for accurate financial assessment and compliance with tax regulations.

Zero-Interest Loans:

- Application: Often seen in personal loans between family members or friends, where the lender does not charge any interest.

- Imputed Interest Role: The IRS imputes an interest rate based on the AFR to ensure that the lender reports this ‘phantom’ interest as income, thereby avoiding potential tax evasion.

Below-Market Loans:

- Application: Common in employee benefit packages where companies offer loans to employees at rates lower than the market average.

- Imputed Interest Role: Imputed interest is used to calculate the difference between the market rate and the offered rate. This difference is considered a taxable benefit for the employee and a deductible business expense for the employer.

Corporate Bonds:

- Application: In situations where corporate bonds are issued at a deep discount.

- Imputed Interest Role: Imputed interest comes into play to determine the amount of interest income that bondholders should report annually, even though the actual interest is received only at maturity.

Lease Agreements:

- Application: Particularly relevant in lease-to-own scenarios where the lease payments are significantly lower than market rent.

- Imputed Interest Role: Imputed interest is used to determine the interest portion of lease payments, which can affect the tax treatment of the lease for both lessor and lessee.

Installment Sales:

- Application: In cases where property is sold and the payment is received over a period of time, often without a standard interest rate.

- Imputed Interest Role: Imputed interest is calculated to determine the interest income the seller should report annually. This ensures that the seller pays taxes on the income portion of the installment payments.

Employee Stock Options:

- Application: When employees are offered stock options as part of compensation, often at a price below the current market value.

- Imputed Interest Role: The difference between the market price and the exercise price can be treated as imputed interest, affecting the tax liabilities related to these options.

Private Company Transactions:

- Application: Includes loans between private companies and their shareholders or between related companies at non-market rates.

- Imputed Interest Role: Imputed interest is used to assess the appropriate level of interest that should have been charged, impacting the tax treatment of such transactions.

Gift Loans:

- Application: Loans made without interest or at a rate below the AFR, intended as a gift.

- Imputed Interest Role: The IRS may consider the forgone interest as a gift for tax purposes, affecting the lender’s gift tax liabilities.

In each of these scenarios, the application of imputed interest ensures that financial transactions are aligned with market realities and legal requirements. It plays a critical role in maintaining fairness in financial reporting and tax compliance, particularly in transactions where the exchange of interest is not transparent or reflective of market conditions.

Example of Imputed Interest Calculator Calculation

Let’s say you have a financial transaction with a principal amount of $10,000, and the hypothetical annual interest rate is 5% for 3 years. Using the Imputed Interest Calculator:

- Principal Amount: $10,000

- Annual Interest Rate (%): 5

- Time Period (years): 3

By clicking “Calculate,” the calculator will show that the imputed interest is $1,500.

Advanced Features of Imputed Interest Calculator

Imputed Interest Calculator equipped with advanced features can handle complex financial scenarios with greater precision. These enhanced capabilities allow for more accurate calculations in diverse situations, reflecting the real-world complexity of financial transactions.

Adjusting for Different Compounding Periods:

- Feature: Ability to calculate imputed interest based on various compounding intervals (e.g., daily, monthly, annually).

- Application: This feature is crucial for accurately computing interest in scenarios where the compounding frequency differs from standard annual compounding. For instance, in a loan agreement where interest is compounded monthly, the calculator can adjust the computations to reflect this, providing a more accurate assessment of the interest due.

Handling Variable Interest Rates:

- Feature: Capability to account for variable or adjustable interest rates over the loan period.

- Application: Useful in scenarios where the interest rate of a loan is tied to a fluctuating index or benchmark. For example, in a loan with an interest rate that adjusts annually based on the prime rate, the calculator can recalculate the imputed interest each year as the rate changes, offering a dynamic assessment of interest obligations.

Accommodating Fluctuating Principal Amounts:

- Feature: Flexibility to adjust calculations for loans where the principal amount changes over time.

- Application: Essential in scenarios like revolving credit facilities or lines of credit, where the borrowed amount varies across the loan period. The calculator can account for these fluctuations, recalculating imputed interest based on the varying principal balance.

Inclusion of Grace Periods and Payment Holidays:

- Feature: Ability to factor in grace periods or payment holidays into interest calculations.

- Application: In loan agreements where payments are deferred for an initial period (e.g., student loans with a grace period post-graduation), the calculator can accurately determine the accrued interest during these non-payment periods.

Adjustments for Early Repayments or Additional Payments:

- Feature: Capability to recalibrate interest calculations based on early repayments or extra payments.

- Application: Useful in scenarios where the borrower makes additional payments or repays the loan early. The calculator can adjust the interest calculations to reflect the reduced principal amount, providing an updated interest liability.

Scenario Analysis and Sensitivity Testing:

- Feature: Offering users the ability to model various scenarios, such as changes in interest rates or different repayment schedules.

- Application: Beneficial for borrowers and lenders in assessing how different situations might impact interest obligations. For example, modeling how a change in the prime rate would affect the interest on a variable rate loan.

These advanced features make Imputed Interest Calculator a powerful tool for individuals and businesses. They allow for tailored, precise calculations in complex financial arrangements, ensuring users can accurately assess their financial obligations and plan accordingly. Such detailed analysis is particularly valuable for financial planning, tax preparation, and compliance with lending regulations.

Glossary of Terms: Imputed Interest and Imputed Interest Calculator

Imputed Interest: Interest that is considered as being paid or received, even when no actual interest transaction occurs. It is typically applied in transactions with no or below-market interest rates to align with market conditions for tax purposes.

Applicable Federal Rate (AFR): The minimum interest rate set by the IRS for private loans. It is used to determine imputed interest for tax purposes and varies according to the length of the loan term.

Compounding Periods: The frequency with which interest is added to the principal balance of a loan or investment. Common periods include daily, monthly, and annually.

Variable Interest Rate: An interest rate that can change over the duration of a loan, often tied to an index or benchmark rate like the prime rate.

Principal Amount: The initial amount of money borrowed or invested, before the addition of any interest.

Below-Market Loan: A loan provided with an interest rate lower than the current market rate or the applicable federal rate.

Grace Period: A set period during which a borrower is not required to make payments on a loan, typically seen in student loans.

Payment Holiday: An agreed-upon period where the borrower is allowed to temporarily pause loan repayments.

Early Repayment: The act of paying off a loan or a part of it before its scheduled due date.

Extra Payments: Payments made by the borrower that exceed the regular, scheduled amounts, effectively reducing the principal balance faster.

Scenario Analysis: The process of examining and evaluating potential future events or scenarios to assess possible outcomes in a financial context.

Sensitivity Testing: Analyzing how different variables, such as interest rates or payment amounts, impact a financial model or calculation.

Tax Liability: The total amount of tax owed to a tax authority like the IRS.

Interest Income: Income earned from lending money, or through interest-bearing financial accounts or investments.

Deductible Expense: An expense that can be subtracted from one’s taxable income, reducing the overall tax burden.

Forgone Interest: The interest that could have been earned on a loan but was not charged, often considered in imputed interest calculations.

Gift Tax Implications: Tax consequences that arise when the imputed interest on a loan is treated as a gift, especially in personal loan scenarios.

Corporate Bonds: Debt securities issued by corporations to raise funding, which typically pay interest to bondholders.

Installment Sale: A sale of property where the payments are received by the seller over time, rather than in a single lump sum.

Revolving Credit Facility: A line of credit where the borrower can draw, repay, and re-draw funds up to a specified limit.

This glossary covers key terms associated with imputed interest and its calculation, aiding readers in better understanding the concepts discussed in relation to the Imputed Interest Calculator and its applications in various financial contexts.

Case Studies: Application of Imputed Interest Calculations

Case Study 1: Family Loan for Education

- Scenario: Maria loans her son, Alex, $40,000 to pay for his college education. The loan agreement stipulates a 0% interest rate with a repayment period of 10 years.

- Application of Imputed Interest: The current Applicable Federal Rate (AFR) is 3%. Although no interest is charged, the IRS would consider Maria as receiving imputed interest income annually at the AFR. Therefore, the imputed annual interest income is $1,200 ($40,000 x 3%). Maria must report this as income on her tax return each year, and it may have gift tax implications as well.

Case Study 2: Employer Loan to Employee

- Scenario: A company extends a $50,000 interest-free loan to an employee, John, as part of a relocation package. The loan is repayable over five years.

- Application of Imputed Interest: With an AFR of 2.5%, the imputed annual interest is calculated at $1,250 ($50,000 x 2.5%). This amount is treated as additional taxable income for John, reflecting the benefit received from the interest-free loan. The company can also report this amount as a business expense.

Case Study 3: Below-Market Interest Rate in Business

- Scenario: Sarah, an entrepreneur, borrows $100,000 from her friend at a 1% interest rate to finance her startup. Comparable market rates for such a loan are around 4%.

- Application of Imputed Interest: The IRS would view this as a below-market loan. The imputed interest income is calculated based on the difference between the market rate and the actual rate: $100,000 x (4% – 1%) = $3,000. This imputed interest amount is considered taxable income for Sarah’s friend and a deductible business expense for Sarah’s startup.

Case Study 4: Real Estate Seller Financing

- Scenario: Robert sells a property worth $300,000, offering the buyer a 10-year loan at 2% interest, while the current market rate for similar loans is 5%.

- Application of Imputed Interest: The difference between the market rate and the offered rate (5% – 2% = 3%) is used to calculate the imputed interest. Therefore, the annual imputed interest income is $9,000 ($300,000 x 3%). Robert must report this additional income on his tax return.

Case Study 5: Interest-Free Corporate Shareholder Loan

- Scenario: A corporation lends $200,000 to one of its shareholders, Emily, with no interest charged. The AFR at the time is 3%.

- Application of Imputed Interest: The corporation must recognize imputed interest income of $6,000 annually ($200,000 x 3%). This imputed interest is reported as income by the corporation and as a dividend for Emily, impacting her personal tax liabilities.

These case studies demonstrate the practical application of imputed interest calculations in various contexts, highlighting the importance of understanding and applying these concepts in financial transactions to ensure compliance with tax laws and accurate financial reporting.

FAQs: Imputed Interest and Its Calculation

These FAQs address the fundamental aspects of imputed interest, aiming to clarify common queries and misconceptions, thereby enhancing the reader’s comprehension of this important financial concept.

What is imputed interest?

Imputed interest is the hypothetical interest considered by tax authorities to be paid or received on a loan or financial transaction that either doesn’t have an explicit interest rate or has a rate below the market standard. It is used to align the transaction with market conditions for tax purposes.

When is imputed interest typically applied?

It is applied in scenarios like interest-free or low-interest loans between family members, loans from employers to employees at below-market rates, or in certain seller-financed transactions.

How is the imputed interest rate determined?

The imputed interest rate is usually determined based on the Applicable Federal Rate (AFR) published by the IRS, which reflects the minimum interest rate for private loans for tax purposes.

Is imputed interest applicable to all personal loans?

Not always. Small loans under $10,000 are often exempt. However, for larger loans, particularly those above this threshold, imputed interest calculations are typically necessary to comply with IRS regulations.

Do I need to report imputed interest on my tax return?

Yes, if you are the lender in a transaction where imputed interest is applied, you must report this interest as income on your tax return. For borrowers, the imputed interest may be a deductible expense in certain cases, like business loans.

How does imputed interest affect gift tax liabilities?

In personal loans where the forgone interest (the difference between the imputed interest and any actual interest paid) is significant, it might be considered a gift for tax purposes. This can affect the lender’s gift tax liabilities, particularly if the amount exceeds the annual gift tax exclusion limit.

Can imputed interest change over the life of a loan?

Yes, especially in loans with variable rates or if the applicable federal rate changes. Regular reassessment of the imputed interest may be required in such cases.

Are there any tools available to calculate imputed interest?

Yes, there are online Imputed Interest Calculators that can help estimate the imputed interest based on the principal amount, loan duration, and the current AFR.

Is imputed interest relevant for corporate transactions?

Absolutely. In transactions like corporate shareholder loans or bonds issued at a deep discount, imputed interest is used to ensure that the interest reported for tax purposes reflects market conditions.

Can imputed interest calculations be disputed?

While the AFR provides a standard guideline, unique circumstances or differing interpretations of a financial transaction can lead to disputes. In such cases, consulting with a tax professional is advisable.

Conclusion

The Imputed Interest Calculator is a handy tool for determining the imputed interest on financial transactions when an explicit interest rate is not provided. It helps individuals and businesses make informed financial decisions by quantifying the hypothetical interest in such cases.

Future Trends and Predictions in Imputed Interest

The landscape of financial regulations and practices is continually evolving, and changes in laws or financial norms could significantly impact how imputed interest is calculated and applied. Here are some potential future trends and predictions:

- Changes in Tax Regulations: Tax laws are subject to revision by legislative bodies. Future amendments might alter the way imputed interest is calculated, particularly in how the Applicable Federal Rate (AFR) is determined. Any change in the AFR calculation method or its application criteria could significantly impact imputed interest calculations.

- Digital Currency and Imputed Interest: With the rise of digital currencies and decentralized finance (DeFi), new forms of financial transactions are emerging that may not fit neatly into existing imputed interest frameworks. Future regulations may need to address how imputed interest applies to interest-free or below-market rate loans in the digital currency space.

- Global Economic Changes: Fluctuations in the global economy can lead to changes in market interest rates, influencing the AFR and, consequently, imputed interest calculations. Economic downturns or upturns could prompt regulatory bodies to adjust AFRs to reflect new economic realities.

- Increased Scrutiny on Corporate Loans: There could be a trend towards tighter regulations on corporate loans, especially those involving shareholders or related parties. This may lead to more stringent enforcement of imputed interest rules to prevent tax evasion and ensure fair financial reporting.

- Technology Integration in Financial Reporting: Advancements in financial technology might lead to the development of more sophisticated tools for calculating and reporting imputed interest. These tools could offer more dynamic and real-time calculations, adapting to changes in interest rates or loan terms.

- Focus on Consumer Protection: Future legal reforms may focus more on protecting consumers in private loan agreements, possibly influencing how imputed interest is applied in personal loan scenarios. This could include setting clearer guidelines or thresholds for when imputed interest should be considered.

- Environmental, Social, and Governance (ESG) Factors: As ESG factors become more integrated into financial decision-making, there might be future considerations on how imputed interest is applied in socially responsible investing or in loans for environmental projects.

- International Tax Compliance: With increasing globalization, there might be greater emphasis on aligning imputed interest rules across different jurisdictions to ensure international tax compliance, especially in cross-border transactions.

These trends and predictions highlight the potential areas where changes in laws and financial practices could affect the calculation and application of imputed interest. It’s important for individuals and businesses to stay informed about these developments to adapt their financial strategies and remain compliant with evolving regulations.