In the world of finance, understanding the future value of your investment is crucial. This is where a Maturity Value Calculator becomes an indispensable tool. Designed to project the growth of your investments over time, this calculator takes into account the principal amount, interest rate, and investment period to provide you with a clear picture of what your funds will amount to at maturity.

Ideal for investors, financial planners, and anyone looking to plan their financial future, the Maturity Value Calculator simplifies complex calculations and aids in making informed financial decisions.

How to Use the Maturity Value Calculator

- Enter the Principal Investment: This is the initial amount of money you’re investing.

- Input the Interest Rate: Enter the annual interest rate (in percentage) your investment will earn.

- Set the Time of Investment: Specify the duration of your investment in years.

- Calculate: Click the ‘Calculate’ button to compute the maturity value.

Understanding the Calculation Method

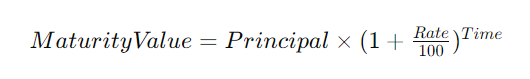

The Maturity Value Calculator uses the compound interest formula:

Where:

- Principal is the initial amount invested.

- Rate is the annual interest rate.

- Time is the investment period in years.

This formula calculates the amount your investment will grow over a specified period, taking into account the compounding of interest.

Maturity Value Calculator Information:

The Maturity Value Calculator is a financial tool that helps individuals determine the final amount they will receive upon the maturity of an investment or savings account. It is commonly used in various financial planning scenarios to estimate the growth of an investment over a specific period.

The calculator takes into account three essential parameters: the principal amount, the interest rate, and the time period. The principal amount refers to the initial investment or savings amount, while the interest rate represents the rate at which the investment grows. The time period indicates the duration for which the investment is held.

Using these inputs, the Maturity Value Calculator employs a formula to calculate the maturity value of the investment. The formula typically multiplies the principal amount by one plus the interest rate (expressed as a decimal) multiplied by the time period. The resulting value represents the expected maturity amount at the end of the investment term.

By providing the Maturity Value, individuals can assess the potential growth of their investment and make informed financial decisions. It allows them to compare various investment options, evaluate the impact of different interest rates, or decide on the optimal investment duration.

The Maturity Value Calculator is widely used by both individuals and financial institutions. Individuals can employ it to forecast the future value of their savings or investments, aiding in financial planning and goal setting. Financial institutions, such as banks or credit unions, often integrate this calculator into their online platforms or provide it as a standalone tool to assist their customers in making investment decisions.

Overall, the Maturity Value Calculator provides a convenient and accessible method to estimate the final value of an investment or savings account, empowering individuals to plan their financial future more effectively.

Maturity Value Calculator: Definition and Significance

The Maturity Value Calculator is a financial tool used to estimate the future value of an investment at a specific date. It is significant for planning long-term financial goals, assessing the growth potential of various investment vehicles, and making strategic investment decisions.

Step-by-Step Calculation Guide for Maturity Value

- Choose an Investment Amount: For example, $10,000.

- Select an Interest Rate: Suppose 5% per annum.

- Decide on an Investment Period: Let’s say 10 years.

- Calculate: The calculator will then display the maturity value.

Examples of Maturity Value Calculations

| Principal | Interest Rate | Time (Years) | Maturity Value |

|---|---|---|---|

| $10,000 | 5% | 10 | $16,288.95 |

| $5,000 | 3% | 5 | $5,796.15 |

| $20,000 | 7% | 15 | $55,836.70 |

Glossary for Maturity Value Calculator

- Principal: The initial sum of money invested.

- Interest Rate: The percentage at which the investment grows annually.

- Maturity Value: The total value of an investment at the end of its term.

- Compound Interest: Interest calculated on the initial principal and also on the accumulated interest of previous periods.

FAQ Section

Q: What is the importance of the maturity value?

A: Maturity value is crucial for planning future financial needs, comparing investment options, and managing expectations regarding returns on investments.

Q: Can the interest rate change the outcome significantly?

A: Yes, even a small change in the interest rate can significantly affect the maturity value due to the power of compounding.

Q: Is it better to invest for a longer period?

A: Generally, longer investment periods result in higher maturity values due to the compound interest effect, but this should be balanced with individual financial goals and risk tolerance.

Q: How often is interest compounded in this calculator?

A: The calculation assumes annual compounding. However, different investments may compound interest at different frequencies.

By understanding and using the Maturity Value Calculator effectively, you can make more informed decisions about your investments and future financial planning.