A Tariffs Calculator is a tool designed to help users calculate the cost implications of tariffs on goods and services, also otherwise known as the “Trump Tariffs Calculator”. Tariffs are taxes imposed on imports or exports, and their calculation can be complex, involving multiple variables like import duties, shipping costs, and applicable taxes. This calculator is ideal for businesses, traders, and consumers looking to understand the cost structures involved in international trade. By using this tool, they can make informed decisions, optimize their supply chains, and manage costs more effectively. Spoiler alert – tariffs cause price increases. See below by how much.

Trump Tariffs Impact Calculator

Current Tariff Rate: 10%

Example Scenarios

Calculating the Trump Tariffs...

Results Explanation

Our team converts drinks into code — fuel us to build more free tools!

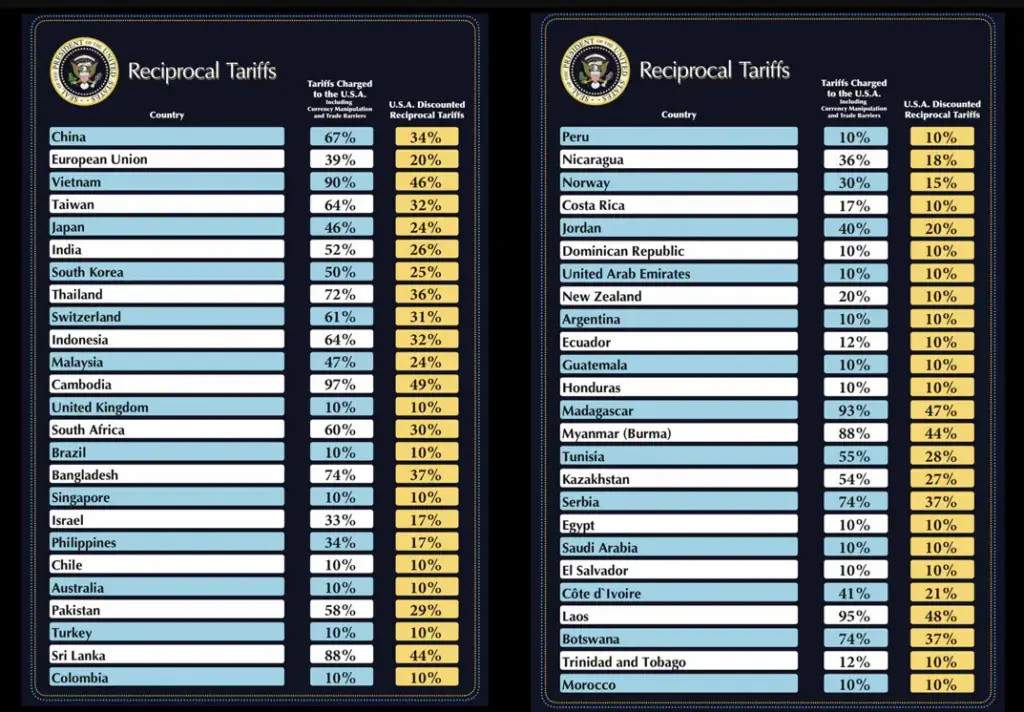

The most recent Trump Tariffs are illustrated below as of April 12th 2025. They are now on pause, all except for China Tariffs.

Report an issue

Spotted a wrong result, broken field, or typo? Tell us below and we’ll fix it fast.

Trump Tariffs: A Closer Look at Reciprocal Tariffs

The chart below presents a comparison of trade tariffs under President Donald Trump’s administration, focusing on the concept of “reciprocal tariffs.” This refers to the idea that if another country charges the United States a certain tariff rate, the U.S. should impose a similar tariff rate in return – essentially mirroring what the U.S. is charged abroad.

Chart Breakdown: Two Key Columns

The chart lists over 50 countries and includes two main data points for each:

- Tariffs Charged to the U.S.A.: The average tariff percentage each listed country imposes on American goods.

- U.S.A. Discounted Reciprocal Tariffs: Suggested reciprocal rates that the U.S. might charge – often lower than what it receives – implying that the U.S. is offering more favorable trade terms.

What This Chart Signifies

President Trump frequently criticized what he saw as unfair trade practices and advocated for more aggressive use of tariffs, especially toward countries like China, India, and members of the European Union. This chart was likely created to:

- Highlight trade imbalances that disadvantage U.S. exporters.

- Justify increased tariffs as part of a rebalancing strategy.

- Support protectionist trade policies aimed at boosting U.S. manufacturing and job creation.

Notable Examples from the Chart

- China: Charges 67% on U.S. goods; U.S. returns only 34%.

- Vietnam: Imposes 90%, with a 46% U.S. reciprocal rate.

- European Union: Charges 39%, while the U.S. reciprocates with just 20%.

- Bangladesh and Cambodia: Among the highest with 74% and 97% tariffs on the U.S.

Conversely, nations like Colombia, Peru, and Argentina already charge only 10%, and receive similar or equal reciprocal rates from the U.S.

Policy Context: The Trump Trade Doctrine

This chart reflects Trump’s “America First” economic philosophy. His administration used tariffs as leverage in trade negotiations to compel other nations to lower their trade barriers. Key moves included:

- Imposing global steel and aluminum tariffs.

- Engaging in a trade war with China, affecting over $500 billion in goods.

- Withdrawing from the Trans-Pacific Partnership (TPP).

- Replacing NAFTA with the United States-Mexico-Canada Agreement (USMCA).

Criticism and Support

Supporters argued these policies strengthened American industry, revived jobs, and restored fairer trade conditions. Critics countered that tariffs raised prices for consumers, disrupted global supply chains, and triggered retaliatory tariffs that hurt American farmers and exporters.

How Do Trump Tariffs Affect You as a Consumer?

If you’re a typical U.S. consumer, you may be wondering how these tariffs actually impact your wallet and daily life. Here’s how:

- Higher Prices on Everyday Products: Tariffs function like taxes on imports. If your washing machine, smartphone, or winter jacket is made abroad, tariffs can raise their retail prices. Importers and retailers usually pass these costs on to you.

- Less Product Variety: If it’s no longer cost-effective for foreign brands to export to the U.S., they may pull out of the market – reducing the variety of choices available to consumers.

- More Expensive Groceries and Packaging: Tariffs on steel, aluminum, and plastic packaging materials can increase food production and packaging costs – raising prices at the grocery store.

- Potential Job Impacts: While tariffs aim to protect U.S. jobs, retaliatory tariffs from other countries can hurt American exports – especially agriculture and manufacturing – leading to job losses or reduced wages in some sectors.

- Economic Ripple Effects: Trade wars can increase uncertainty in the economy, affecting everything from small businesses to retirement accounts. Stock market volatility, delayed investments, and rising interest rates are all possible side effects.

Real-Life Example: After tariffs were placed on imported washing machines, the price of a new washer in the U.S. rose by an average of $86 per unit—even before manufacturers had time to adapt or switch suppliers.

The Bottom Line: Even though tariffs may sound like high-level trade talk, they often result in invisible taxes that show up as higher prices in your everyday life. While they may help some industries, the costs are typically spread across millions of consumers.

This reciprocal tariffs chart serves as a snapshot of the broader trade tensions and strategies used during the Trump presidency. Whether one views these moves as necessary corrections or harmful disruptions, they undeniably reshaped America’s approach to international trade – and affected consumers, businesses, and global alliances in the process.

Note: This chart was likely created by or for advocates of Trump’s trade policy. For fact-checking, it’s always wise to compare against official data from sources like the World Trade Organization (WTO) or the U.S. Trade Representative (USTR). (lead value estimate)

How to Use the Tariffs Calculator?

The Trump Tariffs Impact Calculator helps you quickly estimate the extra costs imposed by tariffs on imported goods. Follow the steps below to understand how to use the calculator effectively.

Step 1: Enter the Import Value

Begin by entering the total cost of the imported goods (in USD) in the Import Value field. This represents the base price of your product before tariffs and shipping costs.

Step 2: Adjust the Tariff Rate

Use the tariff rate slider to set the applicable tariff percentage. The current tariff rate will be displayed in real time. You can also enter the tariff rate manually if you know the exact percentage.

Step 3: Enter Shipping Cost

Input the expected Shipping Cost in dollars. This will be added to the total cost calculation.

Step 4: Use Example Scenarios

If you’re unsure about what values to enter, you can select from a range of pre-set examples. These buttons auto-fill the import value, tariff rate, and shipping costs based on real-world scenarios such as Smartphones, Electric Vehicles, and Luxury Watches.

Step 5: Calculate the Total Cost

Click the Calculate Impact button. The calculator will process the values and display:

- The additional tariff amount

- The final price after including tariffs and shipping

- A breakdown of costs in a bar chart

Step 6: Understanding the Results

Once calculated, the results will appear, showing how much extra you will pay due to the tariff. The breakdown includes:

- Original Cost: The base price of the imported product

- Tariff Amount: The additional cost added due to tariffs

- Shipping Cost: Any additional shipping expenses

- Final Cost: The total amount you will pay

Bonus: Did You Know?

Each calculation generates a random tariff-related fact, giving you insights into how tariffs impact the economy.

Try it Now!

Experiment with different values to see how tariffs affect prices. Understanding the impact of tariffs can help businesses and consumers make informed financial decisions.

Backend Formula for the Tariffs Calculator

The Tariffs Calculator employs a straightforward formula to compute the total cost of imported goods:

Total Cost = Import Value + (Tariff Rate / 100 * Import Value) + Shipping Cost

Import Value: The base cost of the goods being assessed.

Tariff Rate: The percentage tax levied on the import value. For instance, a 5% tariff on $1,000 results in an additional $50.

Shipping Cost: Any additional costs incurred to transport goods, often varying based on distance and weight.

Illustrative Example: If importing goods valued at $5,000 with a 10% tariff rate and $500 shipping cost, the total calculation is as follows:

Tariff Amount = 10% of $5,000 = $500

Total Cost = $5,000 + $500 + $500 = $6,000

Alternative formulas may exist based on specific trade agreements or additional fees, but this method provides a reliable general estimate.

Step-by-Step Calculation Guide for the Tariffs Calculator

Here’s a detailed guide on how to compute tariffs manually, with examples:

- Determine Import Value: Start by identifying the base cost of the goods. This is crucial as it forms the foundation for calculating tariffs. Example: Importing electronics worth $2,000.

- Apply Tariff Rate: Multiply the import value by the tariff rate percentage to find the tariff amount. Example: 7% of $2,000 equals $140.

- Add Shipping Costs: Include any shipping expenses to get the complete cost picture. Example: Shipping is $300, so add this to the import value and tariff amount.

- Calculate Total Cost: Sum all components for the final total. Example: $2,000 + $140 + $300 = $2,440.

Common mistakes include incorrect tariff rates or missing shipping costs, potentially skewing results.

Real-Life Applications and Tips for Using the Tariffs

The Tariffs Calculator has broad applications, supporting various stakeholders in making informed financial decisions:

- Import Businesses: For businesses importing goods, understanding tariff costs can guide pricing strategies and profit margins.

- Customs Brokers: Professionals in logistics and customs can use the calculator to streamline cost estimates for clients.

- Personal Consumers: Individuals making large purchases from abroad can avoid surprises by anticipating additional costs.

For accuracy, gather precise import values, tariff percentages, and shipping rates. Avoid rounding until the final step to maintain precision. Utilize results to develop budgets, forecast expenses, or create competitive pricing models.

Tariffs Case Study Example

Consider the fictional case of Alex, a small business owner importing handmade textiles to sell locally. With fluctuating international trade policies, Alex uses the Tariffs Calculator to stay updated on costs:

Initial Import: Before finalizing an order, Alex inputs an import value of $8,000 with a 12% tariff and $600 in shipping. The calculator shows a total cost of $9,560.

Post-Rate Change: After a tariff adjustment to 15%, Alex recalculates to find the new total cost of $9,900, allowing for informed pricing adjustments.

This scenario illustrates how dynamic tariff calculations can aid in strategic decision-making, optimizing business operations.

Pros and Cons of Using the Tariffs Calculator

While the Tariffs Calculator is a powerful tool, it’s essential to weigh its benefits against potential limitations:

Pros:

- Time Efficiency: Calculators provide instant results, saving time compared to manual computations.

- Enhanced Planning: With accurate cost estimates, users can better plan budgets and pricing strategies.

Cons:

- Over-Reliance: Sole reliance on calculators may overlook nuances like changing tariffs or additional fees.

- Estimation Errors: Incorrect inputs can lead to significant miscalculations, affecting outcomes.

Mitigate these drawbacks by using additional reference materials, consulting experts, and validating data inputs for accuracy.

Example Calculations Table

| Import Value ($) | Tariff Rate (%) | Shipping Cost ($) | Total Cost ($) |

|---|---|---|---|

| 5,000 | 8 | 300 | 5,700 |

| 10,000 | 5 | 700 | 11,200 |

| 3,000 | 12 | 200 | 3,760 |

| 7,500 | 10 | 500 | 8,750 |

| 6,000 | 15 | 400 | 7,300 |

From the table, one can observe how varying tariff rates and shipping costs impact total expenses. An increase in tariff rates results in higher total costs, illustrating the importance of accurate rate tracking for financial planning.

Glossary of Terms Related to Tariffs

- Tariff:

- A tax imposed on imported or exported goods. For example, a 10% tariff on electronics increases the import cost.

- Import Value:

- The initial cost of goods before tariffs or additional fees. Related to the base cost used in calculations.

- Shipping Cost:

- Expenses incurred for transporting goods. This can vary based on distance and delivery method.

- Tariff Rate:

- The percentage applied to the import value to calculate the tariff. Similar to sales tax rates in domestic markets.

Frequently Asked Questions (FAQs) about the Tariffs

Tariff rates are influenced by trade agreements, economic policies, and political relations. They can vary based on product category, country of origin, and current trade negotiations.

Tariff rates can change with government policy updates, trade agreements, or economic shifts. Staying informed through government publications or industry news is crucial for accurate calculations.

While primarily designed for a single currency at a time, users can manually convert currencies before inputting values. It’s essential to use current exchange rates for accuracy.

If shipping is part of the import value, adjust the separate shipping cost input to zero to prevent double counting.

Discrepancies can arise from additional fees, inaccurate inputs, or rounding errors. Double-check entries and consider all potential expenses for a comprehensive estimate.

Further Reading and External Resources

- World Trade Organization (WTO): Provides extensive information on global trade agreements and tariff regulations.

- U.S. International Trade Administration: Offers resources and guidance on trade policies and tariffs for U.S. businesses.

- U.S. Customs and Border Protection: Details on import duties, tariffs, and regulations affecting imports into the United States.