The PayPal Fee Calculator is a tool to help you figure out how much you would be charged by PayPal. It demystifies the costs associated with using PayPal by accurately calculating the fees for each transaction type. Enter the Amount, choose a Transaction type, and hit Calculate. More detailed information about Reverse PayPal Fee Calculations in the text below the calculator.

Total PayPal Fee: $0.00

Net Payment: $0.00

To receive this amount, you should charge: $0.00

This calculator is designed to help you understand the charges you’ll face, thereby enabling better financial planning and transparency. Whether you’re sending invoices, paying for services, or selling products online, this calculator ensures you know exactly what amount you’ll receive or need to send after PayPal fees.

Pardon the colour scheme of this PayPal Fee Calculator – we are experimenting with various CSS versions. If you have suggestions about how to improve it – please post in Comments below.

- Calculate Walmart Seller Fees with this Calculator

- learn more about Etsy Fees – use our Etsy Fee Calculator

- Amazon Seller Fee Calculator

User Instructions for PayPal Fee Calculator

Our PayPal Fee Calculator is designed to help you quickly and accurately estimate the fees for various types of PayPal transactions. Whether you’re sending money for goods and services, processing standard credit and debit card payments, or using PayPal’s checkout options, this tool provides clear and precise calculations.

Step-by-Step Guide – How to Use Reverse PayPal Fee Online Calculator

Entering the Amount

- Locate the Amount Field: At the top of the calculator, you’ll find a field labeled “Enter Amount”.

- Input Your Amount: Type in the amount of money you’re considering to send or receive. Ensure that you input this in US dollars (USD).

Selecting the Transaction Type

- Review the Three Buttons Below the Amount Field: Each button represents a different PayPal transaction type. The options are:

- Send/Receive Money for Goods and Services: This is a standard option for sending or receiving money for goods and services with a fee of 2.99%.

- Standard Credit and Debit Card Payments: This option is for transactions involving credit and debit cards, carrying a fee of 2.99% plus an additional $0.49.

- PayPal Checkout and Others: For using PayPal’s checkout services, including guest checkout and Venmo, with a fee of 3.49% plus $0.49.

- Select the Transaction Type: Click on the button corresponding to your transaction type. The selected button will be highlighted.

Calculating the Fees

- Click the ‘Calculate Fees’ Button: Once you have input the amount and selected the transaction type, click on the green ‘Calculate Fees’ button to compute the fees.

Understanding the Results

- Review the Calculated Fees: After clicking the button, you will see the calculated results displayed in a section below. This section will include:

- Total PayPal Fee: The total amount of fees PayPal will charge for the transaction.

- Net Payment: The amount you will receive after the deduction of PayPal fees.

- To Receive This Amount: If you’re looking to receive a specific amount after fees, this figure tells you how much you should charge.

Error Handling

- If you enter an invalid amount or if there’s an issue with the calculation, an error message will be displayed in red, prompting you to correct the input.

Additional Information about PayPal Fee Calculator

- The calculator is designed for ease of use and provides immediate feedback based on your inputs.

- Remember to select the correct transaction type as fees vary depending on the nature of the transaction.

- The results are calculated based on the latest available fee structure from PayPal and are intended for guidance purposes.

Feel free to use this tool as often as needed to help manage your PayPal transactions more effectively!

Reverse PayPal Fee Calculator also Available

This calculator simplifies the process, providing quick and precise calculations for different types of PayPal transactions. It’s not just about knowing what you’ll pay; with the Reverse PayPal Fee Calculator, you can determine the exact amount to charge to receive a specific amount after fees. Let’s dive into how to make the most out of this versatile and user-friendly tool.

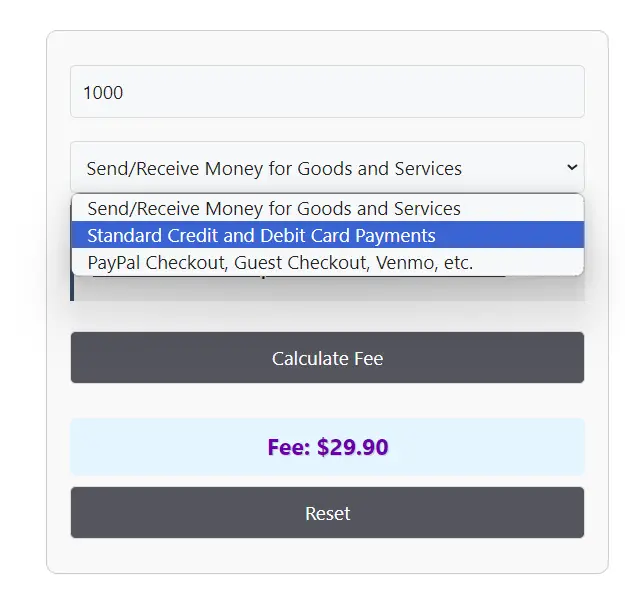

Below is an image of a calculation based on $1,000.00 dollars.

In total, your PayPal Fees would be $29.90.

How to Use the Reverse PayPal Fee Calculator

Using the PayPal Fee Calculator is straightforward:

- Enter the amount you’re sending or receiving in the “Payment Amount” field.

- Select the transaction type from the dropdown menu:

- Send/Receive Money for Goods and Services

- Standard Credit and Debit Card Payments

- PayPal Checkout, PayPal Guest Checkout, Pay with Venmo, All Other Commercial Transactions

- Click on the “Calculate Fee” button to view the applicable PayPal fee.

- The fee amount will be displayed under the “Fee” section.

- To start a new calculation, click the “Reset” button.

Reverse PayPal Fee Calculator

For the reverse calculation, the process is equally simple:

- Input the amount you’d like to receive in the “Payment Amount” field.

- Choose the appropriate transaction type.

- Click “Calculate Fee” to determine the amount you should charge to cover the PayPal fees and receive your desired amount.

- The calculator will display the total amount to charge.

Understanding the Calculation

The PayPal Fee Calculator uses specific formulas depending on the transaction type:

- Send/Receive Money for Goods and Services: The fee is 2.99% of the total amount. The formula is:

Fee = Amount x 0.0299. - Standard Credit and Debit Card Payments: The fee is 2.99% of the amount plus $0.49. The formula is:

Fee = (Amount x 0.0299) + 0.49. - PayPal Checkout and Other Transactions: The fee is 3.49% of the amount plus $0.49. The formula is:

Fee = (Amount x 0.0349) + 0.49.

These formulas take into account the percentage-based fee and any fixed fee components, providing an accurate calculation of the total PayPal fee for each transaction type.

Definition and Background of PayPal Fees

PayPal fees are transaction charges imposed by PayPal for the use of its payment processing services. These fees vary based on the nature of the transaction. Understanding these fees is vital for anyone using PayPal, especially for businesses and freelancers who rely on PayPal for receiving payments.

- Send/Receive Money for Goods and Services: This option is commonly used by businesses and freelancers to receive payments for goods or services. A percentage fee is charged on the total transaction amount.

- Standard Credit and Debit Card Payments: This fee structure applies to payments made using credit or debit cards. It includes a percentage of the transaction amount plus a fixed fee.

- Other Commercial Transactions: This category includes a range of transactions like PayPal Checkout, guest checkouts, and payments via Venmo. The fee structure is similar to credit and debit card payments but with a slightly higher percentage.

PayPal fees are an integral aspect of the platform’s business model, enabling it to provide secure, efficient, and widely accessible payment services. These fees are charged to users, primarily sellers and businesses, for processing payments through its system. Understanding the structure and rationale behind these fees is essential for anyone using PayPal, especially those who frequently engage in monetary transactions as part of their business or personal activities.

History and Evolution of PayPal Fees

PayPal, since its inception in 1998, has evolved significantly, adapting its fee structure to align with its growing user base, technological advancements, and expanding range of services. Initially, PayPal’s primary aim was to simplify online transactions, particularly for users engaged in burgeoning e-commerce platforms like eBay. As PayPal grew and expanded into different markets and services, its fee structure evolved to include various transaction types, international payments, currency conversions, and other financial services.

Types of PayPal Transactions

PayPal categorizes transactions mainly into personal and commercial transactions. Personal transactions, typically involving sending money to family or friends, are usually free if no currency conversion is involved. On the other hand, commercial transactions, which include receiving payments for goods or services, incur fees. This distinction is crucial for users to understand to manage their finances effectively.

PayPal Fee Structure Explained

The fee structure of PayPal is primarily a combination of a percentage of the transaction amount plus a fixed fee, varying based on the nature of the transaction and the countries involved. The percentages and fixed fees are set by PayPal and can be updated periodically. Users engaging in international transactions or currency conversions encounter additional costs, reflective of the complexity and risk involved in such financial activities.

- Domestic Commercial Transactions: These involve a standard fee, typically a percentage of the transaction amount plus a fixed fee. This fee structure compensates PayPal for the use of its platform, covering aspects like transaction processing, security measures, and user support.

- International Transactions: PayPal charges higher fees for international transactions, accounting for the additional costs and risks associated with cross-border payments. These fees include currency conversion charges, which vary depending on the currencies involved.

- Micropayments: For businesses dealing with small transaction amounts, PayPal offers a micropayment fee structure, which is more cost-effective for small-value transactions.

- Nonprofit Organizations: PayPal provides discounted transaction fees for registered nonprofit organizations, supporting their fundraising and operational activities.

Real-World Applications and Examples

PayPal’s fee system plays a critical role in various scenarios, from online shopping and freelancing to fundraising and international remittances. For instance, an online retailer using PayPal to receive payments must factor in these fees when pricing products. Similarly, freelancers who invoice their clients through PayPal need to account for these fees in their billing.

In e-commerce platforms, PayPal’s seamless integration allows for efficient checkouts, but businesses must consider these fees as part of their operating expenses. For nonprofits, the reduced fee structure makes PayPal an attractive option for receiving donations.

Understanding PayPal fees is essential for effective financial management for anyone using the service. By incorporating these fees into pricing strategies and budgeting, businesses and individuals can ensure accurate financial planning and maintain transparency with their clients and customers. As PayPal continues to evolve, staying informed about its fee structure and terms of service will remain crucial for its users.

Table of Example Calculations

Here’s a table illustrating how the PayPal Fee Calculator works with real-world examples:

| Transaction Type | Payment Amount | Calculated Fee |

|---|---|---|

| Send/Receive Money for Goods and Services | $100 | $2.99 |

| Standard Credit and Debit Card Payments | $100 | $3.48 |

| PayPal Checkout, Guest Checkout, Venmo, etc. | $100 | $3.98 |

Explanation of the Table

- Send/Receive for Goods and Services: For a $100 transaction, the fee is calculated as 2.99% of $100, resulting in a fee of $2.99.

- Standard Credit and Debit Card Payments: For the same $100, the fee is 2.99% of the amount plus $0.49, totaling $3.48.

- Other Commercial Transactions: For these, the fee is 3.49% of $100 plus $0.49, coming to $3.98.

Glossary for PayPal Fees

- Transaction Fee: The amount charged by PayPal for processing a payment.

- Percentage Fee: A part of the fee calculated as a percentage of the transaction amount.

- Fixed Fee: A constant amount added to the transaction fee, regardless of the transaction size.

- Commercial Transaction: Transactions involving the buying or selling of goods and services.

- Venmo: A digital wallet service owned by PayPal.

FAQ Section

Q1: Does the PayPal Fee Calculator work for international transactions? A1: The calculator is designed for standard domestic transactions. For international transactions, additional fees may apply.

Q2: Can I use the calculator for micropayments? A2: PayPal has different fee structures for micropayments. The calculator is not configured for these special rates.

Q3: Are the fees different for nonprofit organizations? A3: Yes, PayPal offers discounted fees for registered nonprofit organizations.

Q4: How can I reduce PayPal fees? A4: Consider using alternatives for larger transactions, as PayPal’s percentage fees can be significant. Negotiating rates for high-volume transactions can also be beneficial.

Q5: Are the calculated fees the same for all currencies? A5: The fees can vary based on the currency. The calculator is based on fees for transactions in U.S. dollars.

Additional Online Reading Material about PayPal Fees

Here are several useful online resources that provide detailed information about PayPal fees, each offering unique insights and perspectives:

- PayPal’s Official Website: This is the most direct and official source for information on PayPal fees. It provides detailed information about the fee structure for various types of transactions, including cryptocurrency transactions, international donations, and personal transactions.

- Merchant Maverick’s Complete Guide To PayPal Fees: A comprehensive guide that breaks down PayPal’s fee structure into major categories, explaining the monthly charges for different PayPal services.

- Shopify’s Guide on PayPal Fees: Relevant for e-commerce businesses, this guide compares PayPal fees with other payment gateways and explains how PayPal integrates with Shopify Payments.

- NerdWallet’s PayPal Fees and Rates List for Small Businesses: Tailored towards small business owners, this resource offers a clear summary of PayPal’s payment processing rates, ranging from 1.9% to 3.5% per transaction, plus a fixed fee.

- Talus Pay’s Explanation of PayPal Fees: Provides practical tips for understanding and saving on PayPal fees, covering various aspects of PayPal’s fee structure, including balance transfers, and PayPal Payments Pro and Virtual Terminal fees.

Each of these resources provides valuable insights and detailed information that can help users navigate PayPal’s fee structure effectively, whether you’re a small business owner, a nonprofit organization, or an individual user.