The Barista FIRE Calculator is an innovative tool designed to assist individuals in mapping out their financial future with the Barista FIRE (Financial Independence, Retire Early) strategy. This approach allows you to leave your full-time job earlier than traditional retirement age, relying on a combination of part-time work and investment income to cover your living expenses.

With this calculator, you can visualize your financial trajectory, making it easier to plan and achieve your Barista FIRE goals. Let’s dive into how to use this calculator effectively, understand the underlying formulas, and navigate your path towards financial independence with confidence.

The calculator includes input fields for current age, annual take-home pay, annual expenses, invested net worth, desired Barista FIRE age, annual spending in retirement, and monthly income during the Barista FIRE phase. Calculation and reset buttons allow for easy interaction, displaying results and enabling adjustments as needed.

How to Use the Barista FIRE Calculator

This online calculator is designed to help you plan for a Barista FIRE lifestyle, where you achieve financial independence and have the option to retire early, possibly working a part-time job or engaging in less stressful work to cover some of your living expenses. Follow these steps to understand your financial situation better and plan your path to Barista FIRE.

Step 1: Enter Your Current Financial Information

- Current Age: Input your current age in years. This is the starting point for calculating how many years you have until you reach your desired FIRE age.

- Current Annual Take-Home Pay: Enter the total amount of money you earn annually after taxes and other deductions. This figure helps in understanding your saving potential.

- Current Annual Expenses: Input how much you spend in a year. This includes all your expenses such as housing, food, transportation, leisure, etc. It’s crucial for calculating your savings rate and how much you need for retirement.

- Invested Net Worth: Enter the total current value of all your investments. This includes stocks, bonds, retirement accounts, and other forms of investments but excludes non-liquid assets like your primary home.

Step 2: Define Your Retirement Goals

- Desired Barista FIRE Age: Input the age at which you wish to achieve financial independence and possibly retire from full-time work. This is your target FIRE age.

- Annual Spending in Retirement: Estimate how much money you will need each year during retirement. This should cover all your expected annual expenses in retirement.

- Monthly Income During Barista FIRE: If you plan to work part-time or have a passive income source during your Barista FIRE phase, enter the expected monthly income from these sources.

Step 3: Calculate Your Path to Barista FIRE

- Once you have filled in all the required fields, click on the Calculate button. The calculator will process your inputs and provide an estimation of your financial scenario by your desired FIRE age.

- If any field is left blank or contains invalid numbers, you will receive an error message prompting you to fill in all fields with valid numbers.

Step 4: Interpret Your Results

- The results will display an estimation of your invested net worth by your desired FIRE age, considering your current financial information and retirement goals.

- If the calculator identifies a savings shortfall, it will also estimate the additional monthly income you would need during your Barista FIRE phase to meet your annual retirement spending goal.

Step 5: Reset and Recalculate as Needed

- If you wish to adjust your inputs and recalculate, you can click on the Reset button to clear all fields and start over.

Tips for Using Barista FIRE Calculator

- Be Realistic: Enter realistic and accurate figures to get the most useful insights from the calculator.

- Experiment: Feel free to experiment with different scenarios, such as adjusting your desired FIRE age or monthly Barista income, to see how it affects your financial plan.

- Review Regularly: Your financial situation and goals may change over time, so revisit and recalculate your Barista FIRE plan regularly.

By following these steps and tips, you can effectively use the Barista FIRE calculator to plan for your financial independence and early retirement goals.

The Formula Behind the Barista FIRE Calculator

The core of the Barista FIRE Calculator lies in its ability to project your financial future using a combination of the compound interest formula and adjustments for inflation.

The formula for calculating the final amount:

where P is the principal amount, n is the annual growth rate, and t is the time in years. The calculator further refines these projections by incorporating the safe withdrawal rate (SWR), which determines the annual spending rate from your investments without depleting the principal over time.

By default, a 4% SWR is used, based on the Trinity Study’s recommendations for a balanced investment portfolio.

Inflation is accounted for by adjusting the nominal investment growth rate by the expected inflation rate, providing a real rate of return that preserves the purchasing power of your projected assets. This inflation-adjusted growth rate ensures that your financial projections remain realistic and grounded in economic conditions.

Step-by-Step Calculation Guide

- Input Your Current Financial Data: Start by filling in your current age, annual take-home pay, annual expenses, and current invested net worth.

- Define Your Barista FIRE Goals: Enter your desired Barista FIRE age, annual spending in retirement, and expected monthly income during the Barista FIRE phase.

- Adjust Growth and Inflation Rates: Use the sliders to set your expected investment growth rate and inflation rate, along with the safe withdrawal rate.

- Calculate: Click the “Calculate” button to see how your financial trajectory aligns with your Barista FIRE goals. The graph will update to show your progress towards full FIRE.

- Interpret the Results: Analyze the graph to understand when you can realistically transition to Barista FIRE and how your net worth is expected to grow over time.

- Adjust and Recalculate: If needed, adjust your inputs or financial strategy based on the results and recalculate to explore different scenarios.

What is Barista FIRE: Definition and Background

Barista FIRE refers to a financial independence strategy that allows individuals to retire from their primary career earlier than traditional retirement age, without fully retiring from work. Instead of ceasing work entirely, one transitions to a lower-stress, part-time job (“Barista” job) that covers daily living expenses, while investments continue to grow until full financial independence is reached. This approach is particularly appealing for those who seek to balance the desire for early retirement with the practicality of maintaining a source of income and benefits, such as health insurance, often available through part-time employment.

The concept of Barista FIRE is part of the broader FIRE movement, which emphasizes living below one’s means, investing a significant portion of income, and pursuing financial independence to enjoy greater freedom and flexibility in life. Barista FIRE offers a more accessible path for many, as it does not require accumulating as large a financial nest egg as traditional FIRE strategies, which aim for complete retirement from all work.

The concept of Barista FIRE

The concept of Barista FIRE has been gaining traction among those who aspire to retire early but are looking for a balanced approach that mitigates some of the financial pressures associated with early retirement. This strategy is a subset of the Financial Independence, Retire Early (FIRE) movement, which advocates for savings and investment strategies that enable individuals to retire far earlier than conventional retirement ages. However, Barista FIRE takes a slightly different approach by blending the desire for early retirement with the practical benefits of continued employment, albeit in a reduced and less stressful capacity.

Logic behind the Barista FIRE Movement

At its core, Barista FIRE involves reaching a level of financial independence where one’s savings and investments can cover a significant portion of their living expenses, but not necessarily all of them. Instead of quitting work entirely, individuals pursuing Barista FIRE choose to work part-time jobs. These jobs not only provide a steady income stream to cover daily expenses without dipping into retirement savings but also can offer benefits like health insurance, which can be a significant concern for early retirees in countries without universal healthcare.

The term “Barista” FIRE is inspired by the idea of someone working as a barista in a coffee shop—a role that’s often part-time and considered to be lower stress compared to a full-time corporate job. However, the concept applies broadly to any part-time work that offers flexibility, enjoyment, or fulfillment, without the high demands or stress of a person’s previous full-time career.

Background and Evolution of the FIRE Movement

The FIRE movement, from which Barista FIRE derives, has its roots in the early 1990s with the publication of “Your Money or Your Life” by Vicki Robin and Joe Dominguez. This book laid the foundation for thinking about financial independence as a means to reclaim one’s life from the demands of consumerism and the traditional work until you’re 65 paradigm. Over the decades, the movement has evolved and branched into various strategies, including Lean FIRE (extreme frugality), Fat FIRE (maintaining a higher standard of living in retirement), and Barista FIRE.

The growth of the internet and social media has significantly contributed to the FIRE movement’s popularity, providing a platform for sharing success stories, strategies, and advice. Personal finance blogs, forums, and online communities have become invaluable resources for those seeking to achieve financial independence.

Why Barista FIRE?

Barista FIRE appeals to individuals for several reasons:

- Flexibility and Balance: It offers a more balanced approach to early retirement, allowing individuals to enjoy some of the freedoms of retirement without completely giving up work.

- Financial Security: Continuing to work part-time can help mitigate the risk of running out of money, which is a common concern among early retirees, especially during economic downturns or unexpected personal circumstances.

- Healthcare Benefits: In many cases, part-time employment provides access to health insurance and other benefits, addressing one of the major challenges of early retirement in the absence of employer-sponsored health benefits.

- Social and Mental Engagement: Working part-time can also fulfill social needs and provide a sense of purpose or identity that many people derive from their careers, without the stress and time commitment of full-time work.

Barista FIRE offers a practical and appealing path to early retirement for those who seek financial independence but also value the structure, social engagement, and security that part-time work can provide. It represents a shift in how we think about work, retirement, and financial security, emphasizing flexibility and personal fulfillment over the traditional linear career path followed by full retirement. As the FIRE movement continues to evolve, Barista FIRE remains a testament to the diverse approaches individuals can take to achieve their financial and lifestyle goals.

Real-Life Scenarios and Calculations with Barista FIRE Calculator

To illustrate the practical application of the Barista FIRE strategy, let’s consider a few hypothetical scenarios. These examples will demonstrate how individuals with different financial situations might plan their path to Barista FIRE, taking into account their current age, annual take-home pay, annual expenses, invested net worth, desired FIRE age, annual retirement spending, and expected monthly income during Barista FIRE.

Scenario Calculations

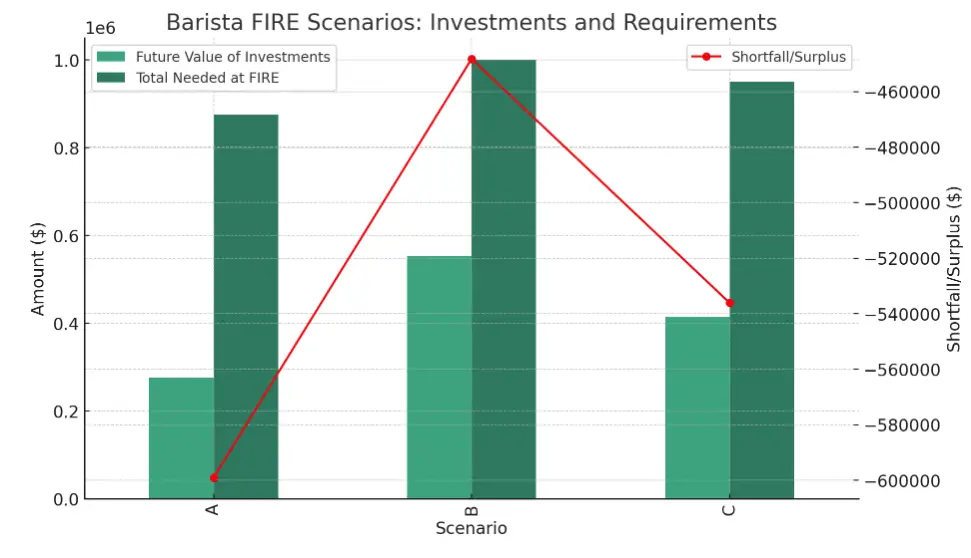

Let’s perform the calculations for each scenario to see how each individual’s Barista FIRE plan might look in terms of numbers. We will now calculate the future value of investments, total needed at FIRE, and the shortfall or surplus for each scenario.

Based on the calculations for each scenario, here are the updated results, incorporating the future value of investments, the total needed at FIRE, and the shortfall or surplus for each scenario:

Table of Real-Life Scenarios and Calculations for Barista FIRE

| Scenario | Current Age | Annual Take-Home Pay | Annual Expenses | Invested Net Worth | Desired FIRE Age | Annual Retirement Spending | Monthly Barista Income | Years Until FIRE | Future Value of Investments | Total Needed at FIRE | Shortfall/Surplus |

|---|---|---|---|---|---|---|---|---|---|---|---|

| A | 30 | $60,000 | $40,000 | $100,000 | 45 | $35,000 | $1,200 | 15 | $275,903 | $875,000 | -$599,097 |

| B | 40 | $80,000 | $50,000 | $200,000 | 55 | $40,000 | $1,500 | 15 | $551,806 | $1,000,000 | -$448,194 |

| C | 35 | $70,000 | $45,000 | $150,000 | 50 | $38,000 | $1,000 | 15 | $413,855 | $950,000 | -$536,145 |

Explanation of Calculations

- Future Value of Investments: Calculated based on the current invested net worth and assuming an annual return rate of 7% over 15 years.

- Total Needed at FIRE: The required nest egg to cover annual retirement spending indefinitely, calculated using a 4% safe withdrawal rate (25 times the annual expenses).

- Shortfall/Surplus: This reflects whether the future value of the investments at the desired FIRE age will be sufficient to cover the total needed for retirement. A negative value indicates a shortfall, suggesting that additional savings, a higher rate of return, or adjustments to retirement spending may be necessary.

These scenarios underscore the importance of planning and flexibility in the Barista FIRE strategy. They highlight how variables such as the amount saved, the expected return on investment, and the desired standard of living in retirement can significantly impact the feasibility and timing of achieving financial independence.

Below you can find a more simple table of calculations for Barista FIRE:

| Scenario | Current Age | Desired FIRE Age | Annual Take-Home Pay | Annual Expenses | Invested Net Worth | Monthly Barista Income | Annual Retirement Spending |

|---|---|---|---|---|---|---|---|

| Example 1 | 30 | 40 | $60,000 | $40,000 | $50,000 | $1,500 | $30,000 |

| Example 2 | 35 | 45 | $75,000 | $50,000 | $100,000 | $2,000 | $40,000 |

These examples illustrate how different inputs can affect the timeline and financial strategy for reaching Barista FIRE. By adjusting your annual take-home pay, expenses, and Barista income, you can explore various paths to achieving your desired lifestyle in retirement.

The chart visualizes the Barista FIRE scenarios for three different examples, showing both the future value of investments and the total amount needed at the desired FIRE age. It also illustrates the shortfall or surplus for each scenario, providing a clear comparison of how each scenario measures up against the financial goals for early retirement. This visualization helps in understanding the financial feasibility and planning required for achieving Barista FIRE under various conditions.

Quick Glossary for Barista FIRE Calculator

- FIRE (Financial Independence, Retire Early): A movement focused on extreme savings and investment to enable retiring far earlier than traditional retirement age.

- Safe Withdrawal Rate (SWR): The percentage of your investments you can withdraw annually without running out of money during retirement.

- Investment Growth Rate: The average annual return expected from your investments, not adjusted for inflation.

- Inflation Rate: The rate at which the general level of prices for goods and services is rising, eroding purchasing power.

Detailed Glossary for Barista FIRE Movement

1. Barista FIRE: A financial strategy where individuals aim for early retirement from their main career but continue to work a part-time job that covers daily expenses. This allows them to rely less on their savings, as their investments continue to grow, potentially covering health insurance and other benefits.

2. FIRE Movement: Stands for “Financial Independence, Retire Early.” It’s a lifestyle movement that emphasizes aggressive saving and investing to achieve financial independence and the option to retire much earlier than traditional retirement age.

3. Financial Independence: The state of having sufficient personal wealth to live, without having to work actively for basic necessities. For financially independent people, their assets generate income that is greater than their expenses.

4. Early Retirement: The act of retiring from one’s career or main occupation before the traditional retirement age, often by achieving financial independence.

5. Investment Portfolio: A collection of financial investments like stocks, bonds, real estate, and cash equivalents, as well as their fund counterparts. A well-diversified portfolio is crucial for achieving FIRE.

6. Safe Withdrawal Rate (SWR): The percentage of funds that one can withdraw from their retirement savings each year without running out of money. A common SWR used in FIRE calculations is 4%.

7. Annual Return Rate: The percentage growth of an investment over a specified period, usually one year. It’s critical for calculating how investments will grow over time towards achieving FIRE.

8. Part-Time Employment: Work that requires fewer hours per week than full-time jobs, often offering more flexibility and less stress, which is appealing for those pursuing Barista FIRE.

9. Savings Rate: The proportion of income saved and invested towards retirement. A higher savings rate accelerates the journey to financial independence and early retirement.

10. Compound Interest: The interest on a loan or deposit calculated based on both the initial principal and the accumulated interest from previous periods. It’s a powerful force in growing investments over time.

11. Net Worth: The total value of an individual’s assets minus liabilities. In the context of FIRE, a higher net worth indicates closer proximity to achieving financial independence.

12. Passive Income: Earnings derived from a rental property, limited partnership, or other enterprises in which a person is not actively involved. For many in the FIRE movement, generating passive income is a key strategy.

13. Financial Planning: The process of estimating the amount of money required to achieve various goals in life and planning out the saving and investing route to reach those goals.

14. Budgeting: The process of creating a plan to spend your money, allowing individuals to determine in advance whether they will have enough money to do the things they need or would like to do.

15. Asset Allocation: The process of spreading investments among various categories of assets, such as stocks, bonds, real estate, and cash, to optimize the balance between risk and return in a portfolio.

This glossary provides a foundational understanding of the key terms and concepts related to the Barista FIRE movement and the broader quest for financial independence and early retirement.

Barista FIRE Calculator FAQ Section

Q1: What is Barista FIRE?

A1: Barista FIRE is a financial strategy where you retire from your primary job early but continue to work part-time to cover living expenses while your investments grow.

Q2: How is the Safe Withdrawal Rate (SWR) used in the calculator?

A2: The SWR helps determine how much you can annually withdraw from your investments without depleting your net worth, crucial for planning your retirement spending.

Q3: Can I adjust the investment growth and inflation rates in the calculator?

A3: Yes, the calculator allows you to adjust both rates to reflect your personal financial expectations and strategy.

Q4: How does the calculator account for inflation?

A4: Inflation is accounted for by subtracting the inflation rate from the investment growth rate, providing an inflation-adjusted rate of return.

Q5: What happens at the Barista FIRE age in the calculator’s graph?

A5: The graph shows a change in the growth trajectory of your net worth at the Barista FIRE age, reflecting the transition from full-time work to part-time income and investment returns.

By understanding and utilizing the Barista FIRE Calculator, you can effectively plan your journey towards financial independence, tailoring your strategy to fit your personal financial situation and goals. This guide equips you with the knowledge to confidently navigate the calculator, understand the principles behind Barista FIRE, and make informed decisions on your path to early retirement.

Frequently Asked Questions (FAQ) about Barista FIRE

1. What is Barista FIRE?

Barista FIRE refers to a financial independence and early retirement strategy where individuals leave their full-time careers but continue to work part-time jobs. This approach allows them to cover their living expenses through part-time work while letting their savings and investments continue to grow until they reach full financial independence.

2. How does Barista FIRE differ from traditional FIRE?

Traditional FIRE (Financial Independence, Retire Early) aims for complete financial independence and retiring from all forms of work. Barista FIRE, on the other hand, involves working a part-time job after leaving a full-time career to cover living expenses, thus requiring a smaller nest egg than traditional FIRE.

3. Who should consider Barista FIRE?

Barista FIRE is ideal for individuals who seek to retire early but are willing to continue working part-time to maintain a steady income for living expenses. It’s also suited for those who value work-life balance and wish to pursue passions or interests without the financial pressure of a full-time job.

4. What are the benefits of Barista FIRE?

- Reduced stress: Transitioning to part-time work can significantly reduce job-related stress.

- Flexibility: Offers more free time to pursue hobbies, travel, or spend time with family.

- Lower financial threshold: Requires a smaller savings amount than achieving full FIRE, making early retirement more accessible.

5. What are the downsides of Barista FIRE?

- Continued employment: You’re still tied to the workforce and dependent on part-time income.

- Benefits: Part-time positions may offer limited benefits, such as health insurance.

- Income variability: Part-time income may be less stable, affecting financial planning.

6. How do I calculate my Barista FIRE number?

To calculate your Barista FIRE number, estimate your annual living expenses and subtract any income you expect to earn from part-time work. Multiply the remainder by 25 to estimate the total savings needed to support your lifestyle without full-time employment.

7. Can I still achieve Barista FIRE if I have debt?

Yes, but it may require more planning and saving. Prioritizing debt repayment is crucial before transitioning to part-time work to ensure financial stability in early retirement.

8. How do I find the right part-time job for Barista FIRE?

Consider jobs that align with your interests or offer flexible schedules. Many opt for positions that provide benefits, like health insurance, or opportunities in fields they’re passionate about.

9. Is Barista FIRE sustainable long-term?

Sustainability depends on careful financial planning, including a conservative withdrawal rate from savings, a buffer for unexpected expenses, and adaptability to changing financial circumstances.

10. How do health insurance and benefits work with Barista FIRE?

Since part-time jobs may offer limited benefits, researching healthcare options, including the Affordable Care Act marketplaces or health sharing plans, is essential. Some pursue part-time work specifically for employer-provided health insurance.

11. Can Barista FIRE help me avoid early withdrawal penalties from retirement accounts?

Yes, by relying on part-time income, you may reduce the need to withdraw from retirement accounts early, potentially avoiding penalties. However, it’s important to plan strategically for accessing retirement funds in line with IRS rules and regulations.

This FAQ section aims to address common inquiries about the Barista FIRE movement, offering insights into its advantages, considerations, and strategies for successful implementation.

Additional Reading Material about Barista FIRE Movement and Barista FIRE Calculator

For anyone interested in exploring the Barista FIRE strategy further, we’ve curated a list of online resources that provide valuable insights, practical advice, and real-life examples to help you understand and potentially pursue this path to financial independence and early retirement.

- NerdWallet – What Is Barista FIRE, and Is It a Good Retirement Strategy?: This source offers a comprehensive overview of the Barista FIRE concept, including its benefits and drawbacks. It’s a great starting point for beginners to understand the basics and the financial implications of choosing this path.

- The Balance – Understanding Barista FIRE: A New Trend in Retirement Planning: The Balance provides a detailed look into the Barista FIRE movement, emphasizing how it fits within the broader FIRE movement and the lifestyle considerations it entails. It’s selected for its thorough explanation of the lifestyle and financial planning aspects of Barista FIRE.

- Investopedia – Barista FIRE: Financial Independence While Working Part-Time: Investopedia is known for its clear and concise financial advice, and this article breaks down the concept of Barista FIRE in an easy-to-understand manner. It’s ideal for those seeking a deeper dive into the strategy’s financial mechanics.

- HowToFire – What Is Barista FIRE?: This resource explores the practical steps to achieve Barista FIRE, including calculating your Barista FIRE number and considering the lifestyle benefits and compromises. It’s chosen for its actionable advice and real-life application tips.

- Reddit’s BaristaFIRE Community: For firsthand experiences and advice from individuals pursuing or living the Barista FIRE lifestyle, this subreddit is invaluable. It offers a platform for questions, success stories, and challenges, making it a great resource for community support and real-world insights.

These resources were chosen for their comprehensive coverage, clarity, and the varied perspectives they offer on the Barista FIRE strategy. They range from beginner-friendly explanations to more in-depth financial planning discussions, ensuring readers can find information that matches their current understanding and interest level.