The Simple Coast FIRE (Financial Independence, Retire Early) Calculator is an essential tool for those aiming to strategically plan their retirement, offering a clear visualization of the necessary savings to achieve financial independence.

This Simple Coast FIRE calculator demonstrates how much you need to accumulate in your retirement accounts so that, without additional contributions, your assets will sufficiently grow to support your lifestyle in retirement.

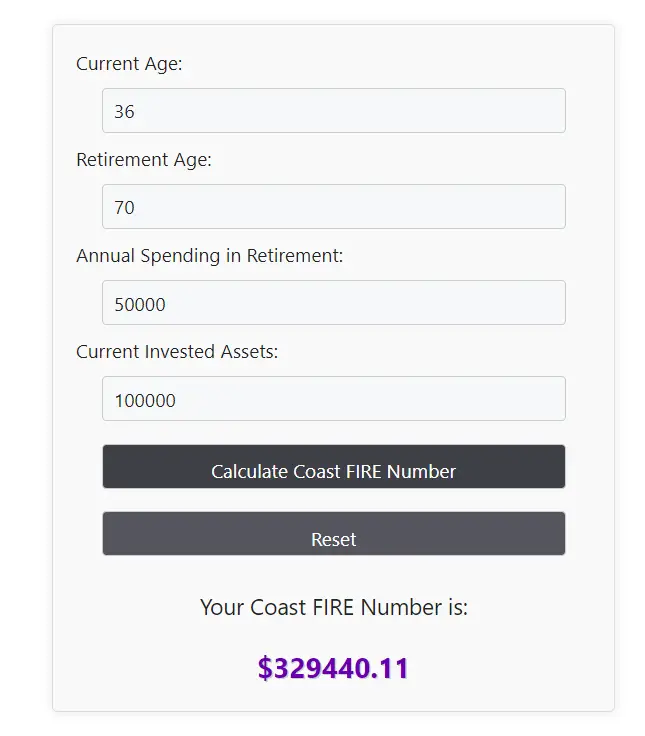

How to Use the Coast FIRE Calculator

The Coast FIRE Calculator is a simple yet powerful tool. Follow these steps to determine your Coast FIRE number:

- Enter Your Current Age: Input your current age in years.

- Enter Your Planned Retirement Age: Specify the age at which you plan to retire.

- Annual Retirement Spending: Input the estimated annual amount you plan to spend during retirement.

- Current Invested Assets: Enter the total current value of your invested assets.

- Calculate: Click on the ‘Calculate Coast FIRE Number’ button to view your required savings.

- Reset if Needed: Use the ‘Reset’ button to clear all inputs and start a new calculation.

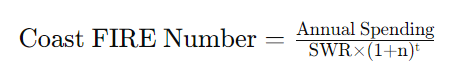

Understand the Formula behind Coast FIRE Calculator

The Coast FIRE Calculator utilizes a compound interest formula to compute your required retirement savings. The formula is:

Where:

- Annual Spending is your expected yearly expenditure during retirement.

- SWR (Safe Withdrawal Rate) is typically 4%, representing the portion of your net worth you can withdraw annually.

- n is the adjusted annual growth rate (investment return minus inflation rate).

- t is the number of years until retirement.

The calculator factors in inflation, ensuring the results are relevant in today’s financial context.

Step-by-Step Calculation Guide for Coast FIRE

- Input Your Data: Start by entering your current age, retirement age, annual spending in retirement, and current invested assets.

- Understanding the Output: The calculator uses your inputs along with a standard SWR of 4% and an average investment return of 7% (adjusted for a 3% inflation rate) to calculate the amount you need today (Coast FIRE number) so that you can stop saving for retirement and still achieve financial independence by your retirement age.

- Interpreting the Result: The result displays the amount you need to have invested now. If your current assets exceed this number, you’ve reached Coast FIRE status.

Definition and Background of Coast FIRE

Coast FIRE, a subset of the broader Financial Independence, Retire Early (FIRE) movement, focuses on reaching a point where your existing retirement savings are sufficient to grow on their own to support your retirement, even if you never contribute another dollar. It represents a milestone where the pressure of saving aggressively for retirement diminishes.

The concept hinges on the power of compound interest and the time value of money. By investing early and allowing your assets to grow, you leverage the potential of your investments to outpace inflation and increase in value over time. This strategy is particularly appealing for individuals who wish to reduce their work hours or pursue less lucrative careers without compromising their retirement plans.

Coast FIRE (Financial Independence, Retire Early) is a financial strategy that has gained popularity among those seeking a more balanced approach to work, savings, and investment. It’s a subset of the broader FIRE movement, which focuses on aggressive savings and investment to achieve financial independence and the possibility of early retirement. To thoroughly understand Coast FIRE, it’s important to break down its core components and implications.

Coast FIRE Concept Explained

Financial Independence: The primary goal of the FIRE movement is to accumulate assets that generate enough income to cover living expenses, eliminating the need to work for money. Financial independence doesn’t necessarily mean retirement but provides the freedom to choose whether to work.

Retire Early: While traditional FIRE advocates for early retirement through aggressive saving and investing, Coast FIRE takes a slightly different approach. It’s not about retiring as soon as possible but reaching a point where you no longer need to save for retirement.

Coast FIRE Milestone

Reaching the Milestone: The Coast FIRE milestone is reached when you have saved enough in your retirement accounts that you no longer need to contribute to them to meet your financial needs in traditional retirement age (usually around 65 years). This is calculated based on projected growth of investments and assumed withdrawal rates during retirement.

Calculation Considerations: To calculate when you’ve reached Coast FIRE, you must consider your current savings, expected return on investment, and the amount you’ll need annually during retirement. It’s a personalized calculation, as it depends on individual lifestyle choices and retirement plans.

Lifestyle and Employment Implications

Career Choices: After reaching the Coast FIRE milestone, individuals have the freedom to choose jobs based on interest and passion rather than salary. This could mean a career change, accepting a lower-paying job that is more fulfilling, or pursuing hobbies and interests that were sidelined due to financial constraints.

Work-Life Balance: Coast FIRE allows for a better work-life balance. People can choose to work part-time, take sabbaticals, or engage in less stressful jobs, as the pressure to save for retirement has been alleviated.

Financial Stress Reduction: Knowing that retirement savings are on track to grow independently can significantly reduce financial stress and anxiety, leading to a more relaxed and enjoyable lifestyle.

Risks and Considerations

- Market Dependency: The strategy heavily depends on the performance of the investment market. Economic downturns can affect the growth of investments, potentially delaying retirement plans.

- Inflation and Cost of Living: Coast FIRE calculations must account for inflation and potential increases in the cost of living, which can impact the required retirement savings.

- Healthcare and Emergencies: Long-term healthcare needs and unforeseen emergencies can affect financial stability. It’s crucial to have a contingency plan or additional savings for such situations.

- Lifestyle Inflation: There’s a risk of lifestyle inflation, where increased spending could erode the financial buffer built for retirement.

Coast FIRE offers a more flexible approach to financial independence, allowing individuals to focus on quality of life and personal fulfillment without the stress of saving for retirement. It requires diligent planning, a solid understanding of personal finance, and a commitment to a long-term investment strategy. Like any financial strategy, it comes with risks and requires continuous assessment and adjustment to stay on track. Ultimately, Coast FIRE is about finding a balance that allows for both financial security and personal happiness.

Here is a table illustrating a few examples of progression towards Coast FIRE, considering different ages, incomes, savings rates, and an assumed constant investment growth rate:

| Age | Annual Income | Annual Savings Rate | Investment Growth Rate | Estimated Net Worth at 65 |

|---|---|---|---|---|

| 25 | $50,000 | 20% | 7% | $1,000,000 |

| 30 | $60,000 | 25% | 7% | $1,500,000 |

| 35 | $70,000 | 30% | 7% | $2,200,000 |

| 40 | $80,000 | 35% | 7% | $3,000,000 |

| 45 | $90,000 | 40% | 7% | $4,000,000 |

This table provides a simplified view of how individuals at different stages in their careers, with varying incomes and savings rates, might progress towards their Coast FIRE goal. The estimated net worth at age 65 assumes a constant 7% annual growth rate on investments. It’s important to note that these are illustrative examples and actual outcomes will vary based on numerous factors including market performance, life events, and changes in income or savings rates.

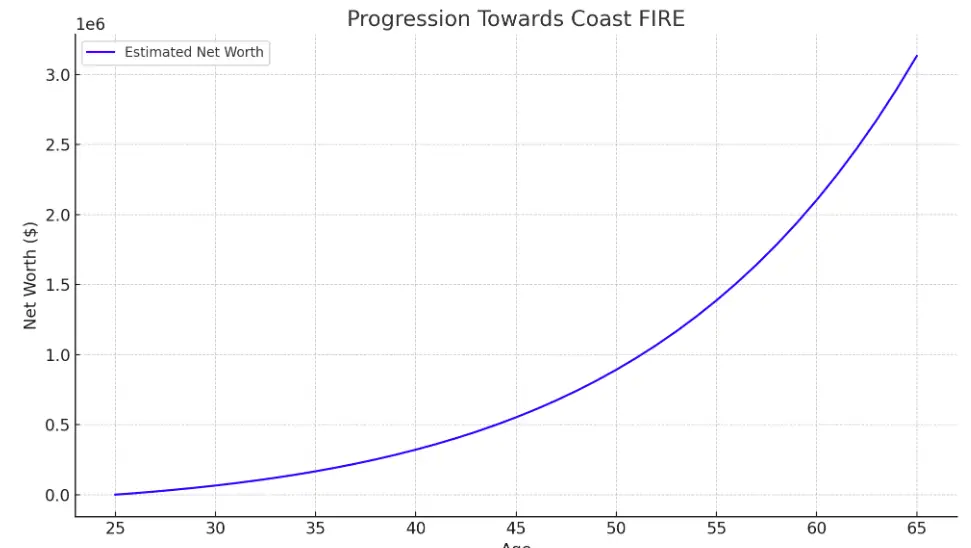

Coast FIRE Progression through a Chart

Here is a chart illustrating the progression towards Coast FIRE. We used example from a table above.

This chart shows the estimated growth in net worth from age 25 to 65, based on the following assumptions:

- Starting annual salary of $50,000, increasing by 3% per year.

- A consistent savings rate of 20% of the annual salary.

- An annual investment growth rate of 7%.

As depicted, the net worth increases steadily over the years, reflecting the compound growth of savings and investments. This chart provides a visual representation of how consistent saving and investing can potentially lead to a substantial net worth, illustrating the concept of Coast FIRE. Keep in mind that this is a simplified model and actual financial outcomes can vary based on numerous factors, including market conditions, changes in salary, and personal circumstances.

Going deeper into the Coast FIRE Calculator Chart territory, it displays the progression of an individual’s estimated net worth from the age of 25 to 65, under a set of specific financial conditions, illustrating the concept of Coast FIRE (Financial Independence, Retire Early). Here’s a detailed breakdown of the chart:

Key Coast FIRE Assumptions

- Starting Annual Salary: $50,000 at age 25.

- Salary Growth Rate: A 3% annual increase, which reflects realistic career progression and annual raises.

- Savings Rate: 20% of the annual salary. This is a crucial aspect of the FIRE strategy, emphasizing consistent and substantial savings.

- Investment Growth Rate: 7% per year. This rate is a common assumption for long-term stock market returns, though actual returns can vary.

Analysis of the Chart

- Initial Phase (Ages 25-35): During the early years, the growth in net worth is gradual. This is because the initial salary and savings are relatively modest. However, even at this stage, the power of compound interest starts to manifest.

- Middle Phase (Ages 35-50): There’s a noticeable acceleration in net worth growth. This is due to two main factors: firstly, the salary has increased over the years due to the assumed annual growth rate, leading to higher absolute amounts being saved. Secondly, the compounding effect of the investments becomes more pronounced over time – as the investment base grows, the same percentage return yields a higher absolute return.

- Later Phase (Ages 50-65): In the final phase, the curve becomes steeper, showing rapid growth in net worth. This is where the effect of compound interest is most powerful. The money that was invested in the earlier years has been compounding, leading to significant growth.

Key Takeaways

- Consistency in Savings: The steady upward trajectory highlights the importance of consistent savings over time, regardless of the absolute amount.

- Compound Growth: The curve’s increasing steepness showcases the exponential nature of compound interest. The longer the investment period, the greater the growth in net worth due to compounding returns.

- Long-Term Perspective: Achieving financial independence, as per the Coast FIRE principle, is a long-term endeavor. The initial years may show modest growth, but patience and consistency are key.

- Impact of Salary Increases: The gradual increase in salary over the years contributes significantly to the acceleration of net worth growth. It demonstrates how career advancement and salary growth can positively impact financial goals.

Limitations

- Market Variability: The chart assumes a constant 7% investment growth rate, which might not be realistic given market fluctuations.

- Life Changes: Major life events, such as buying a house, having children, or unforeseen emergencies, can impact one’s ability to save or the need to withdraw investments.

In summary, the chart is a simplified representation to illustrate the concept of building wealth over time through consistent savings and investment, underpinning the Coast FIRE strategy. It emphasizes the power of compound interest and the importance of a long-term financial strategy.

Additional Table of Example Calculations for Coast FIRE

| Current Age | Retirement Age | Annual Retirement Spending | Current Assets | Coast FIRE Number |

|---|---|---|---|---|

| 30 | 65 | $40,000 | $150,000 | $457,000 |

| 40 | 65 | $50,000 | $250,000 | $678,000 |

| 50 | 65 | $60,000 | $350,000 | $905,000 |

Explanation of the Table

- At age 30, with a current asset of $150,000 and planning to spend $40,000 annually in retirement, you would need to accumulate approximately $457,000 by age 65 to reach Coast FIRE.

- At age 40, to spend $50,000 annually in retirement, you need around $678,000 by age 65.

- Similarly, at age 50, with a plan to spend $60,000 annually, you would require about $905,000 by age 65.

Coast FIRE Glossary

This glossary encompasses the key terms and concepts relevant to understanding Coast FIRE. Each term plays a part in the broader strategy of achieving financial independence and the possibility of retiring early, focusing on the balance between saving, investing, and living a fulfilling life before traditional retirement age.

Financial Independence (FI): The ability to cover living expenses solely through personal savings and investments, without needing employment income.

Retire Early (RE): The concept of retiring significantly earlier than the traditional retirement age, often in one’s 40s or 50s.

Safe Withdrawal Rate (SWR): The percentage of your investments you can withdraw annually without depleting your retirement savings prematurely.

Compound Interest: The interest on a loan or deposit calculated based on both the initial principal and the accumulated interest from previous periods.

Inflation Rate: The rate at which the general level of prices for goods and services is rising, eroding purchasing power.

Coast FIRE (Financial Independence, Retire Early): A strategy within the broader FIRE movement focused on accumulating enough retirement savings early in life, so you no longer need to contribute to these savings later. The idea is to “coast” into traditional retirement age without additional retirement savings efforts.

Financial Independence: This term refers to the state of having sufficient personal wealth to live without having to work actively for basic necessities. In the context of FIRE, it specifically means having enough income-generating assets to cover your living expenses.

Retire Early: In the FIRE movement, this refers to the ability to retire much earlier than the conventional retirement age, typically around 65. This is achieved by aggressive savings and investment strategies.

Savings Rate: This is the percentage of your income that you save. In the context of Coast FIRE, a higher savings rate can significantly accelerate the time taken to reach the Coast FIRE milestone.

Investment Growth Rate: The annual rate at which invested money grows. This can be due to interest, dividends, and capital gains. The growth rate is critical in Coast FIRE calculations as it compounds over time, contributing to the increase in net worth.

Net Worth: The total value of all financial and non-financial assets owned by an individual or household minus the value of all its outstanding liabilities. In Coast FIRE, the focus is on growing the investment portion of net worth to a point where no further contributions are needed.

Compounding Interest: This is the process in which the interest earned on an investment is reinvested to earn additional interest. Compounding plays a crucial role in the growth of savings and investments in the FIRE strategy.

Withdrawal Rate: The percentage of your savings that you can withdraw annually during retirement without depleting your nest egg. This rate is essential in determining how much you need to save to sustain your lifestyle in retirement.

Lifestyle Inflation: Refers to increasing one’s spending when income goes up. Lifestyle inflation can be a hindrance in achieving Coast FIRE, as it might lead to lower savings rates.

Salary Growth Rate: The rate at which an individual’s income increases over time. In Coast FIRE planning, this is an important factor as it affects the capacity to save.

Market Variability: This term refers to the fluctuations in investment returns due to changes in market conditions. Market variability is a risk factor in Coast FIRE since the strategy relies on the growth of investments over time.

Financial Buffer: A safety net of extra funds beyond the calculated needs for retirement. This buffer can help manage unforeseen expenses or market downturns.

Traditional Retirement Age: Usually considered to be around age 65. In the context of Coast FIRE, this is the age by which one’s investments should have grown enough to support retirement without further contributions.

Emergency Fund: A reserve of money set aside to cover unexpected expenses or financial emergencies. While not exclusive to Coast FIRE, having an emergency fund is a fundamental part of financial planning.

FAQ Section

Q1: What is Coast FIRE?

A1: Coast FIRE is a strategy in the FIRE movement where you save enough to let your investments grow to support your retirement, without further contributions.

Q2: How is Coast FIRE different from traditional FIRE?

A2: Traditional FIRE involves accumulating enough to fully support retirement expenses immediately, while Coast FIRE focuses on reaching a point where existing savings grow on their own to that level by retirement age.

Q3: Why is the Safe Withdrawal Rate important in Coast FIRE calculations?

A3: The Safe Withdrawal Rate determines the percentage of your portfolio you can safely spend each year in retirement without running out of money.

Q4: How does inflation impact Coast FIRE calculations?

A4: Inflation reduces the purchasing power of money over time. The calculator adjusts for inflation to ensure your savings target is relevant in today’s dollars.

Q5: Can I achieve Coast FIRE if I start saving late?

A5: Achieving Coast FIRE is possible at any age, but starting earlier allows more time for compound interest to work, making it easier to reach your goal.

Q6: What are the key risks associated with Coast FIRE?

A6: The key risks include market volatility affecting investment growth, inflation outpacing the growth of your savings, unexpected life events increasing expenses, and the possibility of underestimating your retirement needs.

Q7: How much do I need to save to achieve Coast FIRE?

A7: The amount varies based on your expected annual expenses in retirement, the age you plan to retire, and your estimated investment returns. A common approach is to use the 4% rule as a guideline for calculating your required nest egg.

Q8: Is Coast FIRE a realistic goal for people with average incomes?

A8: Yes, it can be realistic. The key is to start saving early, maintain a disciplined approach to spending, and invest wisely. The goal isn’t necessarily early retirement but reducing the need to save aggressively later in life.

Q9: How can I calculate my Coast FIRE number?

A9: To calculate your Coast FIRE number, estimate your annual expenses in retirement, determine your desired withdrawal rate, and calculate how much you need in investments for those expenses to be 4% (or your chosen percentage) of your portfolio.

Q10: Does Coast FIRE mean I can stop working altogether?

A10: Not necessarily. Coast FIRE means you don’t have to save for retirement anymore, but you still need to cover your current living expenses. It provides more flexibility in choosing work that may be less stressful or more fulfilling, even if it pays less.

Q11: Can my Coast FIRE plan fail? What should I do?

A11: There’s always a risk of plan failure due to unforeseen circumstances. To mitigate this, regularly review and adjust your plan, maintain an emergency fund, and be flexible about your retirement age and lifestyle.

Q12: How do I manage my investments for Coast FIRE?

A12: A diversified investment portfolio tailored to your risk tolerance and time horizon is crucial. Regularly rebalancing your portfolio and avoiding emotional investment decisions are key strategies.

Q13: What happens if I reach my Coast FIRE goal earlier than expected?

A13: Reaching your goal early gives you options: you could retire earlier, choose to work in a less demanding job, or pursue other interests knowing your retirement savings are on track.

Q14: How should I account for healthcare costs in Coast FIRE planning?

A14: Healthcare costs can be significant, especially in retirement. Ensure your Coast FIRE plan includes sufficient savings to cover health insurance premiums, out-of-pocket expenses, and potential long-term care costs.

Additional Useful Online Resources about Coast FIRE Movement

We found several well-researched online sources that provide comprehensive information about the Coast FIRE financial strategy. Each of these sources offers unique insights and explanations, making them valuable for anyone interested in understanding and potentially pursuing this financial approach:

- Money.com: “What Is Coast FIRE? New Strategy for Early Retirement Saving” – This source offers a detailed look at the Coast FIRE strategy, contrasting it with traditional FIRE. It discusses the feasibility of the strategy, especially for those who may not have high incomes or substantial initial capital. The article also delves into the broader context of the FIRE movement and its growing popularity. The choice of this source is due to its comprehensive overview of Coast FIRE in the context of the wider FIRE movement and its practical considerations. Read more at Money.com.

- Money Flamingo: “Coast FI Explained [includes Coast FIRE Calculator]” – This source provides a clear distinction between Coast FIRE and other variations like Barista FIRE and Flamingo FI. It explains the differences in these strategies and how each impacts the journey towards financial independence. The inclusion of a Coast FIRE calculator makes this source particularly useful for practical application. I chose this source for its detailed comparison of different FIRE strategies and its practical tools for planning. Explore further on Money Flamingo.

- Moneywise: “Coast FIRE: Is It the Right FIRE Path for You?” – Moneywise breaks down the concept of Coast FIRE, explaining how it works, its flexibility compared to full FIRE, and different investment strategies that can be employed. This source stands out for its focus on how to implement the Coast FIRE strategy and the different types of investments that can be beneficial. Learn more at Moneywise.

- How To FIRE: “Coast FIRE: An Easier Way to Pursue Financial Independence” – This source outlines the pros and cons of Coast FIRE, providing an example and explaining how to calculate your Coast FIRE number. It also distinguishes Coast FIRE from other forms of FIRE, like Barista FIRE and Traditional FIRE, offering a clear perspective on the different paths within the FIRE movement. The reason for selecting this source is its detailed explanation of how to calculate the Coast FIRE number and its comparison of Coast FIRE with other FIRE strategies. Discover more on How To FIRE.

Each of these sources was selected for their thorough and unique perspectives on Coast FIRE, providing a well-rounded understanding of the concept, its execution, and how it fits within the broader context of financial independence and early retirement strategies. Good luck on your Coast FIRE journey!