The Savings Rate Calculator for FIRE (Financial Independence, Retire Early) is a crucial tool for those aspiring to achieve financial independence and early retirement. Understanding and monitoring your personal savings rate—the portion of your disposable income that you save rather than spend—is essential.

Enter your monthly Take Home Pay and Monthly spending.

Your Monthly Take-Home Pay is your monthly take home, and it includes taxes that have been taken from your pay. That includes pension such as, 401K contributions or HSA.

Your Monthly spending is your total monthly spending including things like rent / mortgage, insurance, transportation, food and, entertainment

This ratio, typically expressed as a percentage, is a clear indicator of your financial health and progress towards FIRE. The higher your savings rate, the more robust your financial position, bringing you closer to your goals of financial independence and potentially early retirement.

- Coast FIRE Calculator

- Profit Margin Calculator

- Mortgage Amortization Calculator

- Barista FIRE Calculator

How to Use the Savings Rate Calculator for FIRE

Using the Savings Rate Calculator is straightforward and efficient. Simply input your monthly take-home pay and monthly spending into the designated fields. The calculator then computes your savings rate as a percentage. This calculation helps you understand how much of your income you’re saving, a vital metric in your journey towards financial independence and early retirement.

Calculation Formula and Its Importance

The formula for calculating your Savings Rate (SR) is: SR = (Income after tax – Spending) / Income after tax. This formula is critical because it quantifies your ability to save and invest towards your financial goals. A higher savings rate not only accelerates your journey to financial independence but also serves as a buffer against financial uncertainties.

The formula to determine your Savings Rate (SR) is quite straightforward and can be expressed as:

Here’s what this formula means for your financial journey:

- Income after tax: This is the money you take home after all taxes have been deducted.

- Spending: This includes all your expenses—what you spend money on in a given period.

- Savings Rate (SR): This rate is a percentage that represents the portion of your post-tax income that you save.

Importance of the Savings Rate for FIRE:

- Measure of Savings: The SR tells you how much of every dollar you earn is being saved. For example, a 20% savings rate means you save 20 cents of every after-tax dollar you earn.

- Accelerator to Financial Independence: The more you save, the faster you can reach financial independence. A higher SR means you’re putting away more money that can grow over time through investments.

- Financial Security: A substantial savings rate can also act as a financial cushion, making you more resilient to economic ups and downs.

In essence, by keeping your spending lower than your after-tax income and saving the difference, you bolster your financial security and move closer to financial independence. The higher your savings rate, the more you’re securing your financial future and ensuring you’re prepared for any eventualities along the way.

Step-by-Step Calculation Guide

- Determine Your Monthly Income: Enter your monthly take-home pay in the calculator.

- Calculate Monthly Expenses: Input your total monthly spending.

- Compute Savings Rate: The calculator subtracts your expenses from your income, divides the result by your income, and multiplies by 100 to get the percentage.

- Assess Your Financial Health: Use the result to evaluate your progress towards financial independence.

Definition and Background of Savings Rate in FIRE

The savings rate in the context of FIRE is more than just a number; it’s a reflection of your financial lifestyle and discipline. This metric is pivotal in the FIRE movement, which emphasizes frugality, efficient spending, and aggressive saving to achieve financial independence and the possibility of early retirement. The concept gained traction through proponents like Mr. Money Mustache, who highlighted the profound impact of a high savings rate on the journey to financial independence.

What is My Savings Rate / FIRE Savings Ratio?

Your personal savings rate, or savings ratio, is a crucial metric in understanding your financial health. It represents the proportion of your disposable income that you save rather than spend. Essentially, it’s calculated as the ratio of your personal savings divided by your disposable income over a specific period, typically expressed as a percentage. Disposable income here refers to your total income post all income tax deductions.

A higher savings rate indicates a more robust personal financial situation. For instance, a 0% savings rate implies that all your income is spent with no savings. Conversely, a 100% savings rate means all your income is saved with no expenditure.

How Do I Calculate My Savings Rate?

Calculating your Savings Rate (SR) is straightforward. It is defined as the ratio of savings divided by your income. You can calculate your savings over any period as your income minus expenses. Thus, SR = (Income after tax – spending) / (Income after tax). To express this as a percentage, multiply by 100.

Using a Savings Rate Calculator

To simplify the process, you can use an interactive calculator. By inputting your monthly take-home pay and monthly spending, the calculator efficiently determines your personal savings rate.

What Constitutes a Good Savings Rate?

Determining a “good” savings rate is subjective and largely depends on your individual circumstances and saving capacity. Generally, aiming for a minimum savings rate of 20% is advisable. However, while striving for a high savings rate, it’s essential to balance saving with spending enough to enjoy life. For perspective, the Federal Reserve Bank of St. Louis noted that the personal savings rate across the USA was around 14.3% as of September 2020.

Savings Rate and Time to Financial Independence (FIRE)

Your savings rate is a pivotal factor in determining the timeline to achieve Financial Independence, Retire Early (FIRE). As highlighted by Mr. Money Mustache in “The Shockingly Simple Math Behind Early Retirement,” a 0% savings rate equates to never being able to retire, whereas a 100% rate signifies immediate financial independence.

The Savings Rate-FI Relationship

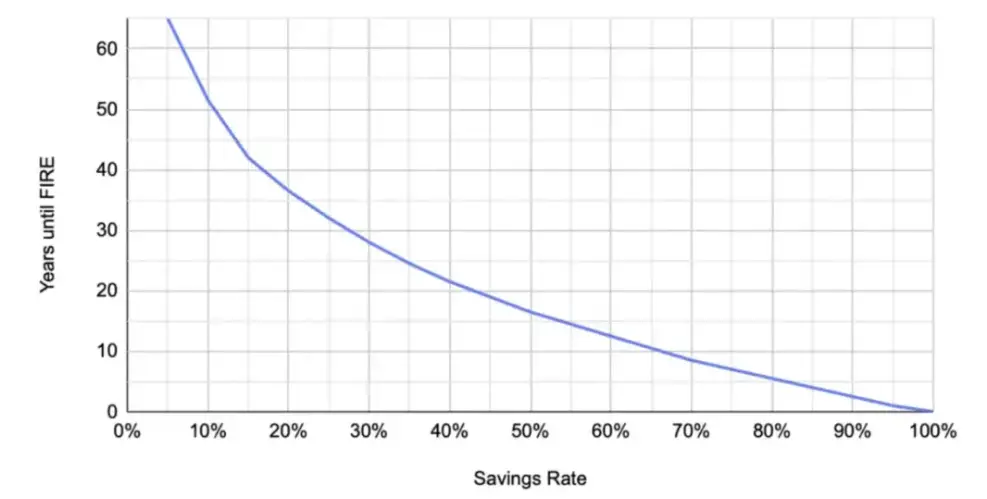

The relationship between savings rate and time to FI is not linear but exponential. This is evident in the table and graph below.

| Savings Rate | Years until FIRE |

|---|---|

| 5% | 65 |

| 10% | 51.5 |

| 15% | 42 |

| 20% | 36.5 |

| 25% | 32 |

| 30% | 28 |

| 35% | 24.5 |

| 40% | 21.5 |

| 45% | 19 |

| 50% | 16.5 |

| 55% | 14.5 |

| 60% | 12.5 |

| 65% | 10.5 |

| 70% | 8.5 |

| 75% | 7 |

| 80% | 5.5 |

| 85% | 4 |

| 90% | 2.5 |

| 95% | 1 |

| 100% | 0 |

This table shows the relationship between the savings rate and the number of years until one can reach Financial Independence Retire Early (FIRE), assuming certain conditions such as investment returns and living expenses. As the savings rate increases, the years until FIRE decrease significantly.

For those on the journey to Financial Independence, Retire Early (FIRE), this table is not just a set of numbers; it’s a roadmap that quantifies the trade-offs between your current lifestyle and the time it will take to reach financial freedom. Let’s delve into the details and implications of this data.

Table Explanation:

The table presents a range of hypothetical savings rates, from 5% to 100%, and correlates each savings rate with the estimated number of years until one can achieve FIRE. The savings rate is calculated as a percentage of your disposable income—that is, your income after taxes—that you save and invest. The ‘Years until FIRE’ is how long it will take you to amass enough savings to cover your living expenses indefinitely, without needing to work for money.

Significance of Savings Rate:

Your savings rate is the single most powerful variable in the FIRE equation. It serves two critical functions:

- The higher your savings rate, the more capital you accumulate to invest. Over time, these investments compound, accelerating your wealth growth.

- A higher savings rate usually means lower annual expenses. Since the FIRE number is often based on a multiple of your annual expenses (like the 25x rule based on the 4% withdrawal rate), lower expenses reduce the total savings required to retire.

Analysis of the Relationship:

The relationship between savings rate and years to FIRE is not linear—it’s exponential. This means that small increments in savings rate, especially at the lower end, can drastically reduce the time it takes to reach financial independence. For example, increasing your savings rate from 10% to 20% could potentially cut down the time to FIRE by almost 15 years.

However, as you move towards higher savings rates, the incremental time saved decreases. Going from 80% to 90% savings rate shaves off far less time, but it reflects an incredibly frugal lifestyle that not everyone may find sustainable or desirable.

Implications for FIRE Aspirants:

For FIRE aspirants, this table serves as a compelling visual to reconsider their current spending habits and savings strategies. It emphasizes the power of aggressive saving and the impact of lifestyle choices on the path to financial independence.

The table is also a stark reminder that the pursuit of a high savings rate should not compromise one’s quality of life to the point of misery. The goal is to find a sustainable balance that accelerates financial independence while still allowing for a fulfilling life.

Strategies for Improvement:

To improve your savings rate, you can employ various strategies:

- Expense Reduction: Cutting down on discretionary spending, optimizing recurring costs, and living below your means.

- Income Increase: Seeking higher-paying jobs, developing side hustles, or creating passive income streams.

- Investment Optimization: Ensuring your savings are not idle but invested in assets that provide a good return, such as index funds, real estate, or other investment vehicles that match your risk tolerance and investment horizon.

Concluding Thoughts:

This table is a compelling illustration of how your current financial habits directly influence the time it will take to achieve financial independence. It’s an invitation to evaluate and adjust those habits as necessary to bring the dream of early retirement closer to reality. It also serves as a reminder that the journey to FIRE is deeply personal, and what constitutes an acceptable savings rate and quality of life varies from person to person.

Chart showing a ratio Years until FIRE vs Savings Rate

Using assumptions like a starting net worth of $0, a 100% allocation into stocks, an 8% rate of return, and a 3% inflation rate, the graph illustrates significant time-to-FIRE improvements at lower savings rates. For example, increasing your savings rate from 10% to 20% can accelerate your journey to FIRE by 15 years, whereas going from 50% to 60% shortens it by only 4 years.

Your personal savings rate is a vital indicator of your financial health and progress towards financial independence. Understanding and actively managing this rate can significantly impact your ability to achieve financial goals, particularly early retirement. While individual circumstances vary, aiming for a higher savings rate, balanced with a fulfilling lifestyle, is a sound financial strategy.

Example Calculations of Savings Rate and Years to FIRE

The relationship between savings rate and time to financial independence is crucial. Consider the following scenarios with different savings rates:

| Savings Rate (%) | Years to Financial Independence |

|---|---|

| 10 | 51.4 |

| 20 | 36.7 |

| 30 | 28.0 |

| 40 | 21.6 |

| 50 | 16.6 |

Explanation: A higher savings rate significantly reduces the time needed to reach financial independence. For instance, increasing your savings rate from 10% to 20% can potentially cut down the time to financial independence by almost 15 years.

Glossary of Terms for FIRE and Savings Rate Calculator

Disposable Income: Income available after taxes.

Financial Independence: The status of having enough income to pay your living expenses for the rest of your life without having to rely on formal employment.

Retire Early (RE): The ability to retire well before the traditional retirement age, often in one’s 40s or 50s.

Savings Rate: Percentage of income saved rather than spent.

Savings Rate (SR): This is the percentage of your disposable (after-tax) income that you save and invest. It serves as a key indicator of financial health and progress toward financial independence.

Disposable Income: This term refers to the net income available to an individual or household after all income taxes have been deducted. It’s crucial because it’s the amount available for saving, investing, or spending on non-essentials.

Financial Independence, Retire Early (FIRE): A movement dedicated to extreme savings and investment, allowing proponents to retire much earlier than traditional budgets and retirement plans would typically permit. The savings rate plays a critical role in achieving early retirement through this movement.

Income after Tax: The take-home pay an individual has left after all federal, state, and payroll taxes have been deducted. It represents the actual earnings that an individual can allocate toward expenses, savings, or investments.

Spending: This is the amount of money spent on goods or services or the act of using funds for expenses. In the context of the savings rate, it is the counterpart to saving; less spending can lead to a higher savings rate.

Investment: Allocating money with the expectation of obtaining an additional income or profit is what defines investing. It’s how saved funds are grown over time, which is essential for achieving financial independence.

Rate of Return: This is the gain or loss on an investment over a specific period, expressed as a percentage of the investment’s initial cost. A higher rate of return can significantly reduce the time needed to reach financial independence.

Compound Interest: Interest added to the principal sum of a loan or deposit, or in other words, interest on interest. It allows investments to grow at an accelerated rate over time, which is a powerful factor in wealth accumulation.

Inflation Rate: The rate at which the general level of prices for goods and services is rising, which can erode purchasing power. It’s an important variable to consider when planning for long-term savings and investment strategies.

Net Worth: The total assets minus total outside liabilities of an individual or a company. It’s a measure of what an entity is worth and an important metric in assessing financial health.

Asset Allocation: An investment strategy aiming to balance risk and reward by dividing a portfolio’s assets according to individual goals, risk tolerance, and investment horizon. Proper asset allocation is crucial to maximizing returns while minimizing risk.

Emergency Fund: A reserve of money set aside to cover potential unforeseen expenses. This financial safety net can prevent the need to incur debt in the case of unexpected expenses.

Frugality: The quality of being economical with money or food; thriftiness. Adopting a frugal lifestyle can lead to a higher savings rate, which, in turn, can speed up the journey to financial independence.

4% Withdrawal Rate: A rule of thumb that retirees use to determine the amount to withdraw from a retirement account each year. It’s a strategy to ensure that retirement savings last throughout retirement, commonly utilized in FIRE planning.

Passive Income: Earnings from a rental property, limited partnership, or other business in which a person is not actively involved. Passive income can contribute to financial independence by providing ongoing income with minimal day-to-day effort.

Understanding these terms and their interconnections is vital for anyone managing their finances and aiming for financial independence.

FAQs on Savings Rate Calculator for FIRE

- What is a good savings rate for FIRE?

- Ideally, aim for a savings rate of at least 20%. However, the higher, the better for achieving financial independence quickly.

- Is it realistic to maintain a high savings rate?

- It depends on personal circumstances, but many in the FIRE community have achieved high savings rates through frugal living and smart financial planning.

- How does the savings rate affect time to FIRE?

- The higher your savings rate, the less time it will take to accumulate enough savings to sustain your lifestyle without working.

- Can I use the savings rate calculator for different income periods?

- Yes, adjust the input for your specific income and spending periods.

- What should I do if my savings rate is low?

- Focus on increasing your income, reducing expenses, or both. Every small increase in your savings rate can significantly impact your journey to FIRE.

Additional Reading Material for FIRE and Savings Rate Calculator

Here are some additional reliable online sources on the topic of savings rates and financial independence (FIRE):

- Fidelity: Fidelity offers a comprehensive overview of financial independence, including what it means and how to work towards it. It’s a trusted name in financial services and provides actionable steps and tools, like a financial independence planner, to help users understand the concepts of FIRE. Their content is tailored to help readers optimize their finances and make progress toward their goals, with a focus on savings rate and its impact on financial independence.

- Playing With FIRE: This source provides a step-by-step guide to achieving financial independence, complete with personal stories and a retirement calculator. It encourages readers to experiment with different savings and spending numbers to understand their path to retirement. The site also emphasizes the importance of knowing why you want financial independence, which is crucial for staying motivated on the FIRE journey.

- ChooseFI: ChooseFI offers a detailed examination of how to calculate your savings rate with various methods. It also provides a savings rate calculator using a recommended approach that factors in income net of taxes. The site is a collaborative platform known for its community-driven content that aims to empower individuals to reclaim their financial independence.

- NerdWallet: NerdWallet is a well-respected source for all things personal finance. While the specific FIRE content was not accessible, the website is known for providing a wealth of resources, calculators, and guides that can aid anyone looking to understand and optimize their financial situation.

- Financial Basecamp: Financial Basecamp breaks down the importance of savings rate and its influence on the timeline to reach financial independence. It also discusses the assumptions behind the calculations, providing a nuanced view of the savings rate’s role in retirement planning. The site aims to help individuals navigate their financial journey with education and tools for better decision-making.

Each of these sources has been selected for its authoritative content, user-friendly tools, and the quality of financial insights provided, making them valuable for anyone interested in learning about savings rates and the path to financial independence.