Stripe Fee Calculator simplifies your financial planning by effortlessly calculating the fees Stripe charges for each transaction. Understanding these fees is crucial for businesses and individuals who use Stripe for payment processing.

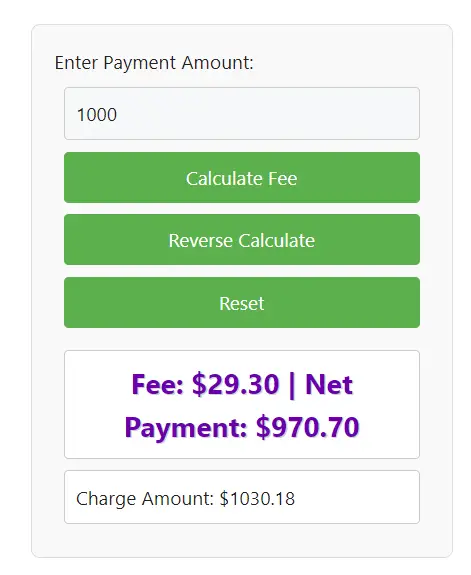

Our calculator takes the complexity out of these calculations, whether you’re looking to determine the charge for a standard transaction or using our Reverse Stripe Fee Calculator to figure out the charge amount needed to receive a specific net payment.

How to Use the Stripe Fee Calculator

Using the Stripe Fee Calculator is straightforward. Enter the payment amount into the designated field. Click ‘Calculate Fee’ to see the Stripe fee and the net payment you will receive.

If you’re interested in finding out how much to charge to receive a specific amount after fees, use the Reverse Stripe Fee Calculator feature. Simply enter the desired net amount and click ‘Reverse Calculate’ to see the required charge amount. The reset button clears all fields and results for a new calculation.

Explaining the Formula

The Stripe Fee Calculator uses a simple formula: 2.9% of the transaction amount plus $0.30. For a transaction of $100, the fee is $100 * 2.9% + $0.30, totaling $3.20.

The net payment would be $100 – $3.20 = $96.80. The reverse calculation formula rearranges this to find the charge amount.

If you want to receive $100, you would calculate (100 + $0.30) / (1 – 0.029), which gives you the amount to charge to cover the fee and receive your desired net payment.

Step-by-Step Calculation Guide

- Standard Calculation:

- Enter the transaction amount.

- Click ‘Calculate Fee’.

- View the Stripe fee and net payment.

- Reverse Calculation:

- Enter the desired net amount.

- Click ‘Reverse Calculate’.

- See the required charge amount to receive your desired net payment after fees.

Definition and Background of Stripe Fees

Stripe fees are integral to Stripe’s payment processing service. Stripe, a widely-used online payment processor, charges a fee for each transaction it processes. This fee is a percentage of the transaction amount plus a fixed amount, currently set at 2.9% + $0.30.

This model is common in the payment processing industry, balancing the need for revenue with the simplicity and predictability that businesses require. These fees cover various costs, including security, technology maintenance, and payment processing infrastructure.

Stripe’s fees, fundamental to its business model, are designed to facilitate and secure online payments. Stripe, an eminent player in the online payment processing market, employs a fee structure typically involving a percentage of the transaction amount plus a fixed fee. As of my last update, this rate was set at 2.9% + $0.30 per transaction. This fee structure is quite prevalent in the payment processing industry and offers a balance between generating revenue and providing a predictable cost model for businesses.

Stripe Fee Definition

- Percentage Fee: The percentage fee (2.9% in Stripe’s case) is applied to the total transaction amount. This is the main component of the fee, reflecting the value of the transaction.

- Fixed Fee: The fixed fee ($0.30 as per Stripe’s standard rate) is a constant amount charged per transaction, irrespective of the transaction size. This helps cover the costs of processing payments, even for smaller transactions.

Background and Rationale Behind Stripe Fees

- Covering Operational Costs: The fees charged by Stripe are designed to cover a range of operational costs. This includes maintaining and developing their technological infrastructure, ensuring secure and reliable payment processing, and providing customer support.

- Security Expenses: A significant portion of Stripe’s fees goes towards implementing and maintaining high-security standards. This is crucial in protecting sensitive financial data and preventing fraud.

- Payment Network Fees: Stripe operates within the broader financial and banking ecosystem, interacting with credit card networks and banks. A part of the fees goes towards paying these networks and financial institutions for their services.

- Software Development and Updates: Continuous improvement and updating of their payment gateway and associated software are essential for keeping up with the evolving digital payment landscape. Stripe invests in software development to enhance user experience and introduce new features.

- Business Model Sustainability: The fee structure is also a critical component of Stripe’s business model. It allows the company to generate revenue while offering its services to a wide range of businesses, from small startups to large enterprises.

- Market Competitiveness: Stripe’s fee structure is designed to be competitive within the payment processing market. It aims to offer a balance between cost-effectiveness for clients and profitability for the company.

- Ease of Use and Predictability: By employing a simple and transparent fee structure, Stripe makes it easier for businesses to understand and predict their costs associated with payment processing. This is vital for businesses in budgeting and financial planning.

Comparison of Stripe Fees with Industry Standards

- Competitive Pricing: Stripe’s fees are in line with industry standards, similar to other major players like PayPal and Square.

- Simplicity and Transparency: Unlike some competitors, Stripe is known for its straightforward fee structure without hidden charges, making financial planning more manageable for businesses.

In conclusion, Stripe’s fees are a critical aspect of its service offering, enabling the company to provide secure, reliable, and user-friendly payment processing services. The fees reflect a balance between the cost of providing these services and the need to remain competitive in the payment processing industry.

Table of Example Calculations for Stripe Fees

Here’s a table showing examples of how Stripe fees are calculated:

| Transaction Amount | Stripe Fee | Net Payment |

|---|---|---|

| $50.00 | $1.75 | $48.25 |

| $100.00 | $3.20 | $96.80 |

| $150.00 | $4.65 | $145.35 |

Explanation:

- For a $50 transaction, the Stripe fee is $50 * 2.9% + $0.30 = $1.75, leaving a net payment of $48.25.

- A $100 transaction incurs a $3.20 fee, resulting in a net payment of $96.80.

- For $150, the fee is $4.65, with a net payment of $145.35.

Glossary for Stripe Fees

- Transaction Amount: The total amount of a sale or payment.

- Stripe Fee: The fee Stripe charges for processing a transaction.

- Net Payment: The amount received after the Stripe fee is deducted.

- Reverse Calculation: Calculating the charge amount needed to achieve a specific net payment.

FAQ Section

- What are Stripe fees?

- Stripe fees are charges for processing payments, currently at 2.9% + $0.30 per transaction.

- How can I calculate Stripe fees?

- Use the Stripe Fee Calculator by entering the transaction amount.

- What is a Reverse Stripe Fee Calculator?

- It calculates the charge amount needed to receive a specific net amount after fees.

- Is the Stripe fee the same for all transactions?

- The percentage is constant, but the total fee varies with the transaction amount.

- Can I determine the exact amount I will receive after Stripe fees?

- Yes, the Stripe Fee Calculator provides this information based on your input amount.

Additional Reading Material about Stripe Fees

We found several online resources that offer comprehensive information and analysis on Stripe’s fee structure, which could be valuable for understanding how these fees are applied and their implications for businesses.

- Stripe Official Site: This is the primary source for information about Stripe’s fees. It details the various fee structures for different payment methods, including cards, bank transfers, international payments, and additional services like 3D Secure authentication, card account updater, and more. It’s an excellent resource for direct information from the service provider. Stripe Official Site

- Merchant Maverick: This website provides a detailed breakdown of Stripe’s fee structure, including standard fees for different payment methods, chargeback and refund policies, and custom pricing plans. It is particularly useful for its in-depth explanation of how fees are calculated and the various additional costs associated with Stripe’s services. Merchant Maverick

- Wise: Offers a complete guide to Stripe’s pricing and costs, including volume pricing, non-profit organization pricing, and fees for additional services like Stripe Billing, Stripe Connect, and Stripe Radar. This resource is beneficial for its comprehensive coverage of not just the basic fee structure but also the additional products and services offered by Stripe and their respective costs. Wise

- NerdWallet: Provides a summary of Stripe’s processing fees, including standard fees for various payment methods and additional fees for international transactions and other services. It’s a good resource for a quick overview of the fee structure and additional costs. NerdWallet

- Synder Blog: Offers insights into Stripe’s fees, particularly focusing on in-person payments, bank debits and transfers, international payment methods, and processing fees for specific services like Affirm, Afterpay, and Klarna. It’s a useful resource for understanding the specifics of Stripe’s fee structure in different contexts and payment methods. Synder Blog

These resources collectively provide a thorough understanding of Stripe’s fee structure, including how fees are calculated, the specifics for different payment methods, and the costs associated with additional services. They are valuable for businesses considering using Stripe for payment processing and for those who want to understand the potential costs involved.